Nemanja Curcic

When investors seek healthcare stock investments, they usually go for high-profile companies like Johnson & Johnson (JNJ), Pfizer (PFE), and Merck (MRK). Despite centuries of operating history, notably high returns for investors, and a tradition of healthy financial performance, this formidable healthcare player is often overlooked.

Given its enduring status and recent stellar performance, the stock in question is Cigna (NYSE: CI). With more than two centuries of proven profitability, robust fiscal performance, and commitment to healthcare, it is a beacon of stability and a potential source of long-term growth.

About Cigna

Based in Bloomfield, Connecticut, the company can trace its roots back to the Insurance Company of North America, which was founded in 1792. Relying on innovation, strategic partnerships, high-quality and affordable healthcare, and wellness initiatives has brought the company through many downturns, recessions, and shifts in the American and global markets.

Cigna has built a reputation for strong fiscal performance, customer-first policy, and commitment to corporate responsibility. Combining corporate responsibility and sustainable growth with positive health outcomes for individuals and communities has made the company a potentially lucrative investment often unfairly sidetracked by other, more popular stocks.

The company scored #15 in the 2023 Fortune 500 list of the largest American companies by revenue, and in the 2023 Forbes Global 2000 ranking, the corporation was ranked #68. Cigna’s stock is an S&P 500 component, and it trades on the NYSE under the CI ticker stock symbol.

Cigna stock price today

At the time of writing, Cigna stock price stands at $335.13, reflecting a notable increase of $25.03 or 7.5% year-to-date.

Cigna stock price history

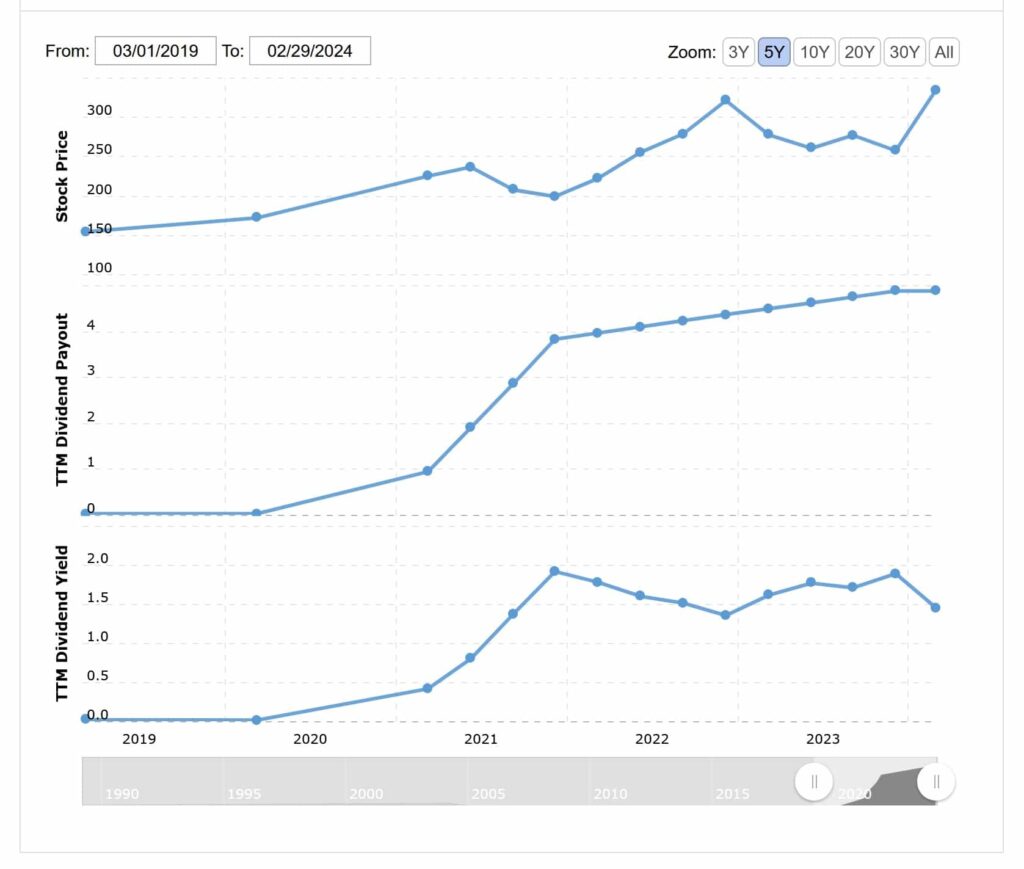

Cigna stock has shown positive financial status in both long and short terms, and the market tends to reward solid indicators over time. The company has steadily increased its annual revenue, earning $174 billion in 2021, $180,5 billion in 2022, and $195 billion in 2023.

Furthermore, CI is a dividend stock with a decades-long tradition of regular dividend payments, making it a solid choice for growth-oriented and conservative traders alike. As of February 26, Cigna stock dividend yield is at 1.44%.

Cigna currently seems to be heavily reinvesting into growing its business, which can result in higher returns and a boost in total earnings. Furthermore, the current indicators reinforce the company’s standard practice of maintaining its growth rate.

Cigna’s centuries-long history

Although Cigna was formed as recently as 1982 by a merger, the companies that formed it were Connecticut General Life Insurance Company (CG) and INA Corporation, founded in 1865 and 1792, respectively. These origins trace Cigna back to one of the oldest American insurance companies, and the merger formed a diversified healthcare company offering various insurance and health-related services.

The company has upheld its adamant commitment to its obligations at all times, which was exemplified during the Great Chicago Fire of 1871 and the San Francisco earthquake and fire of 1906. In both cases, INA was among the few insurance companies to pay its losses in full.

Throughout its history, Cigna has been transforming to adapt to changes in the healthcare landscape and its global footprint. It has made strategic acquisitions and partnerships to boost its portfolio of products and services. Notably, in 2018, Cigna acquired Express Scripts, a leading pharmacy benefit management company, solidifying its position in the healthcare market.

Today, Cigna continues to innovate and evolve, using its expertise to improve healthcare and the well-being of users throughout the U.S. and worldwide.

Why it is often overlooked

The answer is not that simple. One reason is the entanglement of the healthcare and health insurance industry in Cigna’s business model. Dealing in multiple fields like insurance, pharmacy benefits management, and healthcare is more complex than some of the more familiar names among its competition.

Also, Cigna attracted some bad publicity in the eyes of the American public. In December 2007, the company received severe criticism for refusing to cover a liver transplant operation for a California teenage girl, Nataline Sarkisyan. Its reputation went so sour that it was appointed to the American Consumer Satisfaction Index list of the most hated U.S. companies in 2015 and 2018.

Is Cigna stock a buy?

If you can put aside some of the bad rep this healthcare stock accrued over the years, you will see more than two centuries of enviable financial performance and a company that evolved to stay afloat as the world changed.

On top of that, Cigna is today a viable stock purchase even without the prosperous past, with technical indicators and many analysts voicing their support for this stock. Next time you see a flashy healthcare stock, compare it to CI and see which one you would rather put your money on.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.