Albert Brown

Despite Mt. Gox beginning the long-awaited repayment, Bitcoin analysts conclude that the movement of the 47,000 BTC might not impact the market as investors fear.

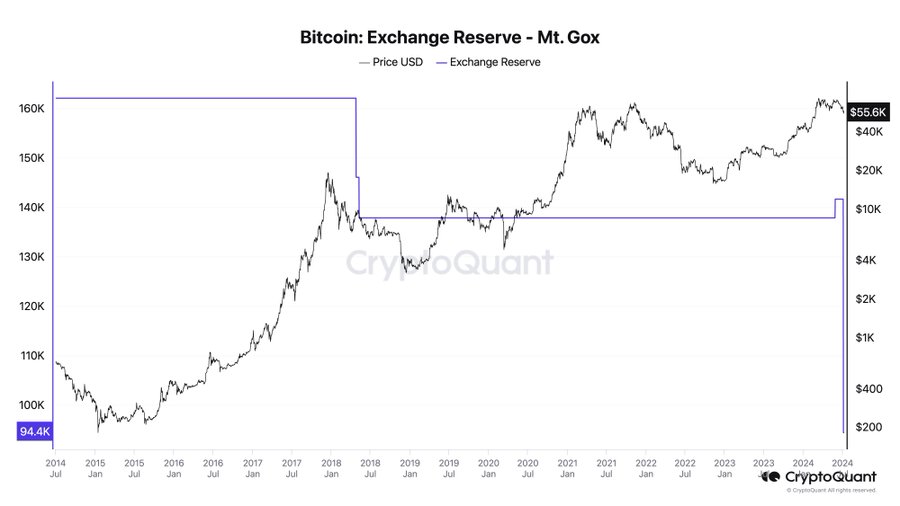

The recent analysis by CryptoQuant chief executive Ki Young suggests that the 47,000 BTC transfer by the defunct exchange Mt.Gox will not affect the BTC price. The post asserts that while the movement is a critical development for Mt.Gox creditors, the transactions will not influence the Bitcoin market price.

Mt.Gox Transfers 47,000 Bitcoin

With creditors set to receive $9 billion worth of Bitcoin (BTC) and Bitcoin Cash (BCH), the recent on-chain movements mark the start of these repayments. Per the CryptoQuant chief’s update, Mt.Gox recently transferred 47,000 Bitcoin.

Mt. Gox moved 47K #Bitcoin, but it won’t affect the price.

Three possible scenarios for these transactions:

1. Internal transfer: Changing wallets for security.

2. OTC deal: Designed not to affect the market price.

3. Using a brokerage service: Likely settled after selling… pic.twitter.com/9xS1zoqfHH— Ki Young Ju (@ki_young_ju) July 8, 2024

News of the transfer aligns with the recent announcement by Mt.Gox Trustee Nobuaki Kobayashi, assuring eligible claimants they will receive compensations in early July after enduring a decade of multiple delays.

The Bitcoin analysts ruled out the 47,000 BTC transaction influencing the price by detailing three possible scenarios. Ju considers the first scenario an internal transfer, possibly changing wallets for security purposes.

Meanwhile, the on-chain analytics firm’s head considers the second scenario an over-the-counter (OTC) trading deal to avoid downward pressure on the BTC market price witnessed during sharp sell-off strategies.

Lastly, he indicates the potential utilization of brokerage services. Ju explains that this scenario represents likely post-sale settlement since the Bitcoin transfer hardly flowed via brokers’ wallets or exchanges.

Broker Role in Mt. Gox Repayments

The analyst notes that while 1,500 BTC went to the crypto exchange Bitbank, the transfer involved a relatively small amount. As such, no significant surge in the Bitbank’s trading volume occurred. The on-chain analytic expert adds that monitoring exchange flows is crucial to ascertain Bitbank’s utilization in the broker role as Mt. Gox’s repayments begin.

The CryptoQuant head considers applying scenario 3 in the transaction, which implies that Mt.Gox will avail 94,000 BTC for the sell-side liquidity. He downplays the likelihood of selling the sizable BTC amount without on-chain movement. Ju’s post assures that if the 47,000 BTC transaction is an OTC selling, the crypto market is clear of the perceived fear of mass dumping.

This comprehensive analysis downplays the FUD surrounding the Mt.Gox repayments to creditors. The analyst vows to keep data conservative, though indicates OTC deal and broker service scenarios are potential reasons the blockchain data shows the coins are still in Mt. Gox wallet.

The call for keeping data conservative by CryptoQuant’s CEO factors the difficulty of certain predictions of market impact in OTC deals. Ju is cautious in ruling out market influence since OTC deals have immediate downstream processes incapable of one to associate.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-