Elmaz Sabovic

Amid the rising uncertainties, geopolitical tensions, and generally an unfavorable economic outlook, investors often turn to the most famous commodity–gold.

While the fight with inflation seems far from over, recent events in the Middle East have increased the buying pressure on gold, leading to its new all-time high of $2,500 on August 1.

With the trend in 2024 so far being overwhelmingly positive, as the gold price surged from $2,058 on January 1 to $2,435 at the time of writing, Finbold decided to utilize OpenAI’s newest addition–ChatGPT-4o, to try and predict the potential price range for the yellow metal by the end of 2024.

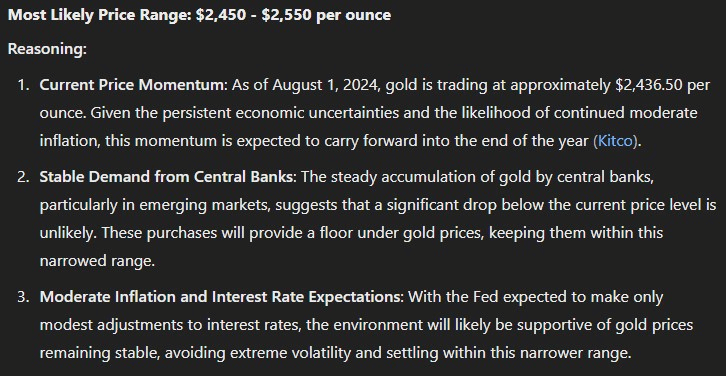

ChatGPT-4o presents the most likely scenario for gold price by the end of 2024

According to the artificial intelligence (AI)-powered chatbot, the price momentum is expected to persist through the end of the year, settling the price range of gold from $2,450 to $2,550 per ounce.

Another stabilizing factor is the steady accumulation of gold by central banks, particularly in emerging markets. This suggests that prices are unlikely to dip significantly below current levels.

These central bank purchases effectively set a floor for gold prices, keeping them within a narrower range.

Additionally, with the Federal Reserve expected to make only modest adjustments to interest rates, the economic environment remains supportive of gold, reducing the likelihood of extreme price volatility and favoring stability as the year progresses.

ChatGPT’s bullish cases offer a wider prediction for gold price

In a bullish scenario, gold prices could rise to between $2,550 and $2,700 per ounce, driven primarily by geopolitical tensions and potential inflationary surprises.

If global conflicts intensify, investors may flock to gold as a safe-haven asset, pushing prices toward the upper end of this range.

However, surpassing $2,700 would likely require an extreme, catastrophic event, which remains an unlikely prospect.

Similarly, if inflation unexpectedly accelerates due to supply shocks or energy price spikes, gold could break above $2,550, though it’s not expected to exceed $2,700 unless inflation reaches crisis levels, which most economic models do not foresee.

Additionally, a significant weakening of the U.S. dollar, potentially stemming from fiscal concerns or aggressive monetary easing, could also support higher gold prices, though the resilience of the U.S. economy may limit the impact to this range.

Bearish case looks unlikely for gold, according to ChatGPT

Conversely, in a bearish scenario, gold prices could retreat to between $2,350 and $2,450 per ounce.

A stronger-than-expected global economic recovery could shift investor sentiment away from safe-haven assets like gold, leading to a decline. A significant strengthening of the U.S. dollar, perhaps due to positive economic surprises or more aggressive Fed tightening, could exert downward pressure on gold.

The ongoing demand from central banks and emerging markets, coupled with persistent geopolitical and economic uncertainties, is likely to prevent a steep drop and keep prices above $2,350.

Given the current economic outlook, even if the Federal Reserve or other central banks were to hike rates more aggressively to combat inflation, the impact on gold would likely be contained.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.