Paul L.

The recent Bitcoin (BTC) spike above $100,000 has elevated the asset to outperform gold by the largest margin in history.

Specifically, Bitcoin is now valued at 36.78 ounces of gold per BTC, a historic high against the traditional store of value, according to data shared by Barchart on December 6.

The data indicates that from its early years, Bitcoin’s price trajectory has been marked by volatile but meteoric rises.

In contrast, gold’s performance has remained steady and relatively flat over the same period, highlighting its traditional role as a safe-haven asset rather than a high-growth investment.

While gold has long been hailed as the ultimate store of value, Bitcoin’s ascent signals a possible paradigm shift in how investors are choosing to preserve wealth.

This development lends credence to Bitcoin’s emerging status as ‘digital gold.’ Interestingly, Federal Reserve Chair Jerome Powell has highlighted the possibility of Bitcoin outperforming gold, noting that the digital currency is a competitor to gold but not to the dollar.

Despite Bitcoin’s rapid growth, the asset significantly trails the precious metal, which boasts a market cap of almost $18 trillion compared to Bitcoin’s $1.9 trillion.

Skepticism on Bitcoin replacing gold

Meanwhile, Bitcoin’s volatility has led some gold advocates to dismiss its potential as a gold replacement. Economist Peter Schiff, for instance, remains a vocal proponent of gold, emphasizing that Bitcoin is destined to crash to zero.

In a November 25 X post, Schiff argued that Bitcoin lacks the intrinsic value needed to serve as a store of value. According to the gold enthusiast, Bitcoin’s appeal is purely speculative, driven by Fear of Missing Out (FOMO) and faith rather than fundamentals.

He claimed Bitcoin’s rising price relies on attracting more buyers and likened investing in it to a risky game where participants must sell before the bubble bursts.

Unlike gold, which Schiff champions for its tangible value, Bitcoin, he argues, is a bet on momentum rather than a reliable hedge.

Conversely, other figures like author and investor Robert Kiyosaki have dismissed the debate between gold and Bitcoin, emphasizing that both asset classes serve the same purpose.

For the celebrity financial educator, both can act as a safeguard, especially during his long-projected historic market crash.

Gold and Bitcoin price movement

Regarding price movements, Bitcoin and gold have had a stellar year. Gold was on track to target the $3,000 mark, but bullish momentum stalled after the United States presidential election.

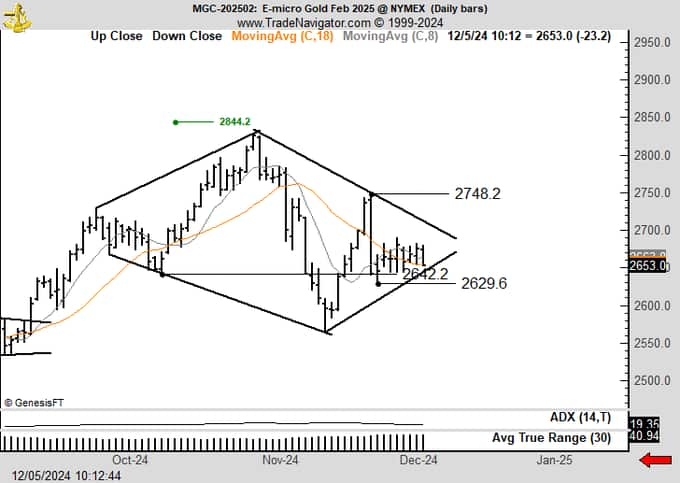

Regarding gold’s outlook, legendary trader Peter Brandt noted in a December 5 X post that the metal’s price action displays a potential diamond pattern—a rare formation that typically signals indecision and possible trend reversals.

Currently, gold is trading near $2,653, with the diamond structure forming between resistance at $2,748.2 and support at $2,629.6.

A breakout above or below these levels could dictate the next major move, but the prevalence of similar patterns across assets has made traders hesitant to trust this signal fully.

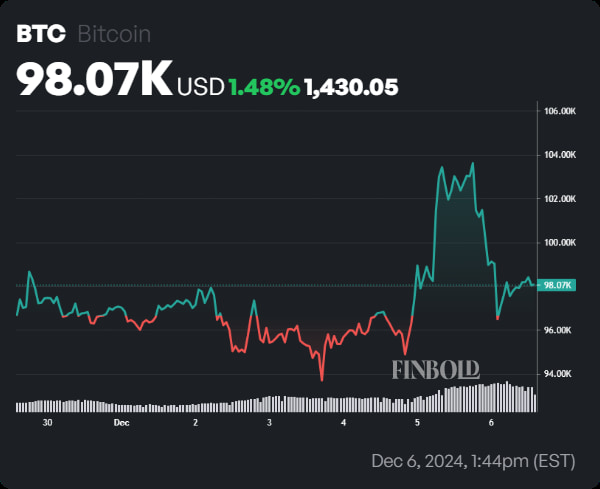

On the other hand, Bitcoin continues to exhibit bullish sentiment despite experiencing a sharp drop below the $100,000 level.

Bitcoin was trading at $98,070 at press time, having corrected by over 4% in the last 24 hours. As it stands, Bitcoin has the potential to reclaim the $100,000 resistance level, supported by its hold above $95,000.

While Bitcoin’s performance against gold has reached historic margins, it’s key to acknowledge that before fully assuming the ‘digital gold’ status, the asset faces some hurdles, particularly in terms of volatility.

Featured image via Shutterstock