Newton Gitonga

XRP Ledger has successfully launched the AMMClawback amendment, introducing new policies governing its Automated Market Maker pools.

The upgrade went live yesterday after attaining 91.43% validator consensus.

The modifications will allow the creation of AMM pools for stablecoin RLSUD.

The development remains crucial as it will likely enhance liquidity for the remittance token while enriching trading opportunities within the XRPL DEX.

What the amendment means

Automated Market Makers are vital in decentralized finance (DeFi) for individuals to trade without old-style order books.

The XRP Ledger unveiled the AMM feature in March 2024, allowing liquidity providers to earn rewards on selected pools.

Meanwhile, specific limits hindered Ripple’s stablecoin from participating in the Automated Market Maker pools.

The restriction arose from the clawback functionality.

The feature allows token issuers to recover tokens in scenarios involving criminal activities, regulatory obstacles, or dealings with sanctioned players.

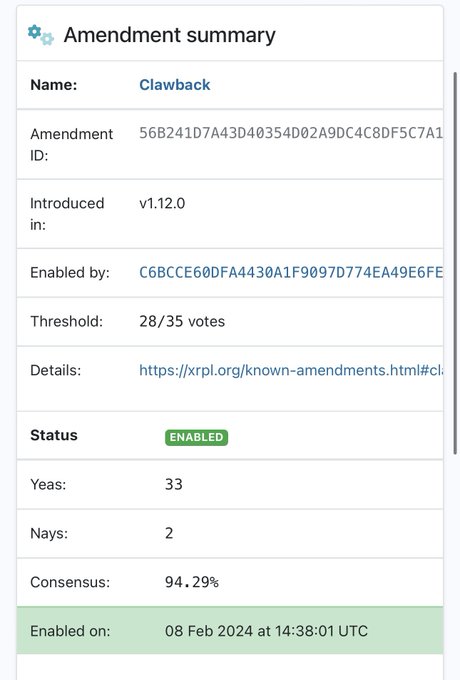

The clawback functionality went live early in 2024.

The XRP Ledger Clawback Amendment is now activated and usable !

Meanwhile, XRPL’s policies banned assets like Ripple stablecoin (as they boast the feature), excluding them from AMM pools.

That restricted RLUSD holders from trading within the XRP Ledger DEX and capitalizing on automated liquidity provision incentives.

The XRPL community launched the XLS-73d amendment to resolve the issue.

The improvement changes how clawback-enables assets interact with the Automated Market Maker pools.

The proposal witnessed massive support from validators, with votes well beyond the approval threshold of 80%.

Meanwhile, the AMMClawback upgrade went live as Ripple’s stablecoin attained a crucial growth milestone.

Ripple USD exceeds $100M market cap

Ripple’s official, Jack McDonald, confirmed impressive growth for RLUSD.

The product topped the $100 million market cap “a little over a month” after its launch.

A little over a month since $RLUSD’s launch, we’ve seen amazing traction hitting ~$100M in market cap. As previously committed, we’ll be publishing a monthly independent attestation for RLUSD, in compliance with the highest regulatory standards.

A few points to keep in mind:…

McDonald clarified that the stablecoin remains over-reserved. That means Ripple’s reserves surpass the RLSUD’s total supply.

We currently hold $6M more in reserves than the total RLUSD supply. Ripple strictly maintains reserves of highly liquid, low-risk assets to ensure our ability to fully meet redemptions.

BitGo’s Brett Reeves predicted an increase in stablecoin adoption this year, citing global regulatory shifts.

XRP price outlook

Ripple’s native token trades at $3.09 after recovering from Monday’s low of $2.74.

The daily chart indicates bearishness as XRP dipped from the daily peak of $3.15.

The declined trading volume signals faded interest, suggesting more dips for XRP before potential rebounds.

Meanwhile, crypto analyst Armando Pantoja expects a massive move for the remittance coin.

He believes a decisive move past the $3.13 – %3.15 resistance region would trigger significant gains to $3.85.

That will magnify optimism in the altcoin, motivating bulls to push towards the historic high of $8.

However, Pantoja warned about potential retracement that might take XRP back to the $3 psychological mark.

Losing this barrier could catalyze further declines to $2.85.

The post XRP Ledger releases AMMClawback amendment as stablecoin RLSUD hits key milestone appeared first on Invezz