Newton Gitonga

Digital currencies performed relatively well on Thursday.

The global cryptocurrency market cap increased by 1.15% over the previous day to $3.7 trillion as Bitcoin tested $110,000 again, trading at $109,899.

While fear still gripped the broader market, Hyperliquid’s native coin displayed substantial bullish momentum.

HYPE climbed from an intraday low of $34 to press time’s $39, a 14.71% surge.

Moreover, its competitor ASTER struggled at the $1 psychological mark after losing more than 3% the past 24 hours.

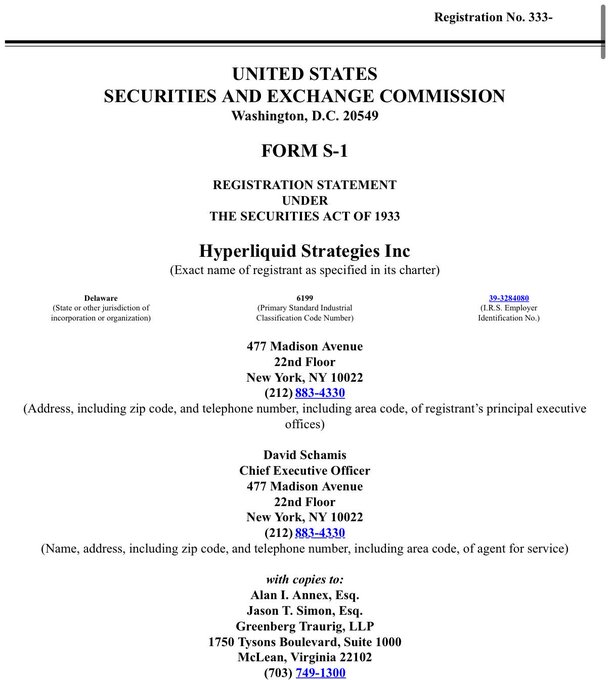

HYPE token turned bullish after news that Hyperliquid Strategies Inc., a crypto treasury firm focused on the Hyperliquid project, officially filed S-1 with the United States SEC to raise $1 billion through a public equity offering.

🚨 JUST IN:

HYPERLIQUID STRATEGIES INC. FILES S-1 WITH THE SEC TO RAISE $1B THROUGH 160M SHARES.

PART OF THE FUNDS FOR POTENTIAL $HYPE TOKEN PURCHASES.

Hyperliquid Strategies, a newly formed digital asset treasury company, is raising $1 billion for general corporate purposes, including the acquisition of Hyperliquid’s native token, HYPE.

The company is being created through a merger between Nasdaq-listed biotech firm Sonnet BioTherapeutics and special purpose acquisition firm Rorschach I LLC. Once completed, the entity will operate as a crypto-focused treasury firm centered on the Hyperliquid ecosystem.

Such narratives triggered bullish sentiments, as they reflect Hyperliquid Strategies’ confidence in its vision of dominating crypto-native liquidity solutions and on-chain treasury management.

The potential $1 billion in new equity funding suggests adequate liquidity for the decentralised exchange.

The Hyperliquid ecosystem can leverage the capital to accelerate governance programs and network development.

HYPE will gain more utility as the DEX expands.

BitMex co-founder Arthur Hayes predicted that Hyperliquid would eclipse Binance and become the largest trading platform globally. He said:

By the end of this cycle, Hyperliquid will be the largest crypto exchange of any type, and Jeff Yan might become richer than CZ, the founder and former CEO of Binance. The Kind is dead. Long live the King!

A recent study by BitCourier shows Hyperliquid is gaining ground, though Binance dominates liquidity with over $40B in daily trading volume.

The DEX’s volume ratio to Binance has increased from 8% early this year to 13.6%. The researchers added:

This growth shows that traders are increasingly confident in Hyperliquid’s ability to deliver deep, on-chain liquidity comparable to major centralized venues.

On the other hand, Binance has seen its share of challenges recently.

For example, the cryptocurrency community has criticised the exchange for facilitating the October 10, 2025, crash.

Binance reportedly froze key functionalities as the market plunged, magnifying losses for users who failed to exit to limit losses.

Now, Hyperliquid Strategies wants to raise $1 billion to accelerate the project’s expansion.

If the deal goes through, the publicly listed company might use the funds to improve liquidity pools, introduce innovative financial tools, and enhance the overall Hyperliquid ecosystem.

Such developments could solidify HYPE’s status as the leading digital coins for decentralised treasuries.

The post HYPE rallies 15% as Hyperliquid’s $1B public offering sparks bullish momentum appeared first on Invezz