Jamie Redman

Non-fungible token (NFT) markets are starting to feel the pain from the crypto market carnage that’s taken place during the last week. Over the last seven days, NFT sales have dropped 42.85% lower than the previous week. NFT sales on Ethereum were hit the hardest as the blockchain saw a 44.83% loss in NFT sales volume this past week.

Crypto Economy’s Downward Spiral Begins to Plague NFT Sales

NFT sales are down this week as seven-day sales metrics show across 16 different blockchains, NFT sales slipped 42.85% lower than last week. Sales stemming from Ethereum were down 44.83%, but the top eight blockchain networks by NFT sales were all down this week.

Solana sales are down 19.65%, Polygon NFT sales slid 35.63%, Flow sales are 36.19% lower, and Avalanche NFT sales are down 29.26%. Tezos, however, saw NFT sales increase 51.09% higher than the week prior.

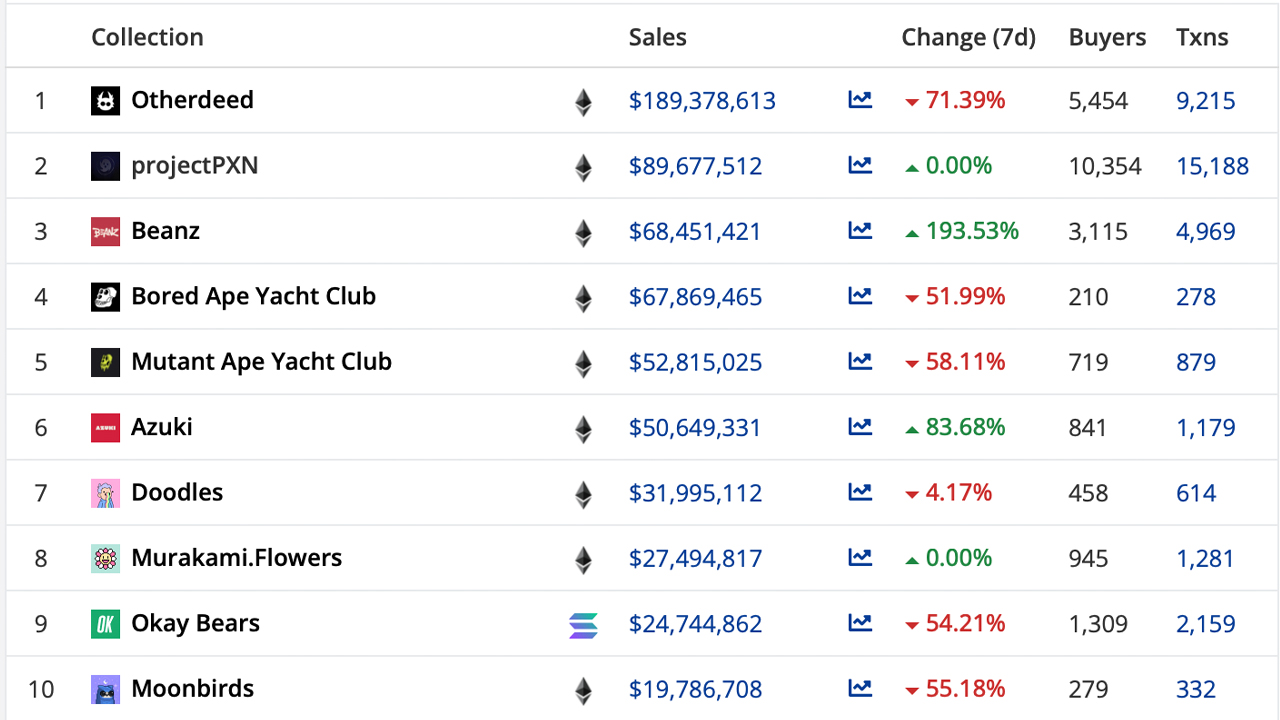

Despite Ethereum-based NFT sales dipping by more than 42%, ETH-based NFTs saw $828.7 million in sales which is 88.17% of the $939.8 million in seven-day NFT sales. The top NFT collection this past week is the Otherdeed NFT compilation which has seen $189.3 million in sales.

Although, Otherdeed sales are down 71.39% during the past seven days. An NFT project called Projectpxn holds the second position in terms of weekly sales with $89.6 million. The NFT project called Beanz has sold $68.4 million in NFTs and sales are up 193.53% higher than last week, according to metrics stemming from cryptoslam.io.

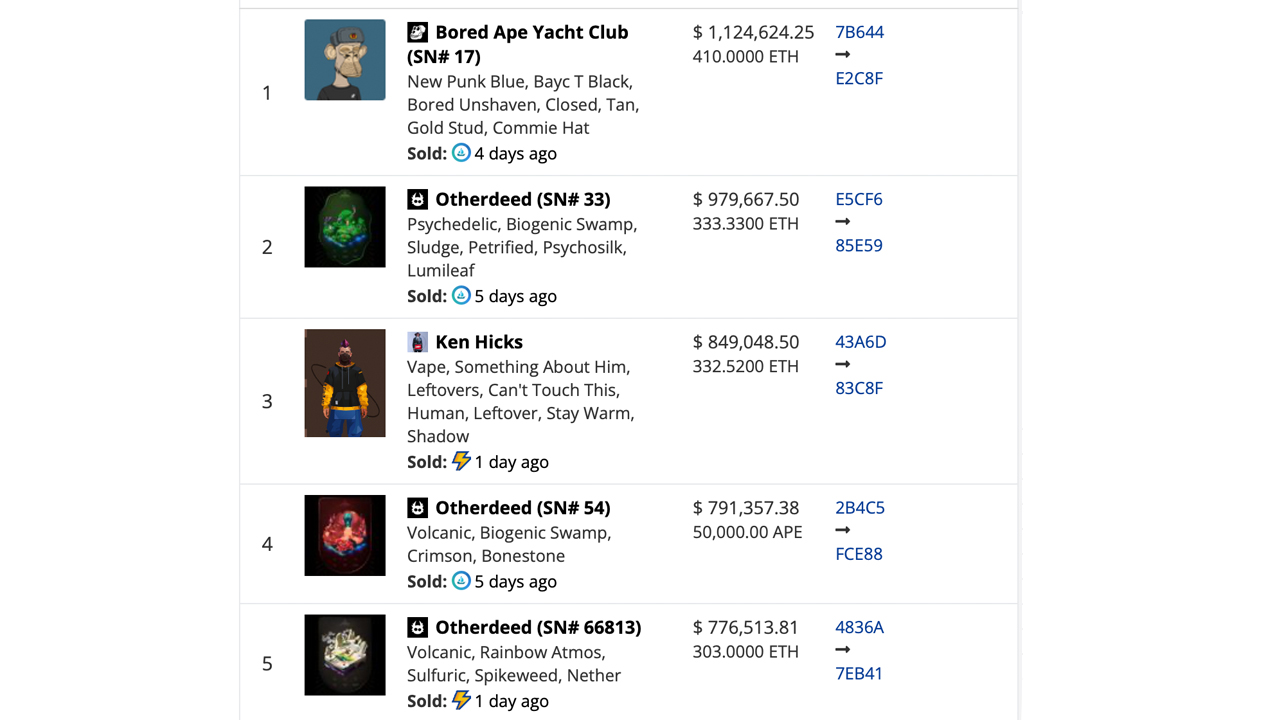

The most expensive NFT sold during the last seven days was Bored Ape Yacht Club (BAYC) 17, which sold four days ago for 410 ether or $1.12 million. Bored ape 17 was followed by Otherdeed 33, and that NFT sold for $979K or roughly 333.33 ether.

An NFT called Ken Hicks sold for 332.52 ether or $849K and Otherdeed 54 exchanged hands for $791K or roughly 50,000 APE five days ago. Otherdeed 66,813 sold a day ago for $776K or 303 ether and Otherdeed 26 exchanged hands for $733.5K or 249 ether five days ago.

What do you think about this week’s NFT sales volume dropping 42% lower than last week? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.