Newton Gitonga

Digital tokens witness limited recoveries as Bitcoin attempts a break past $97K.

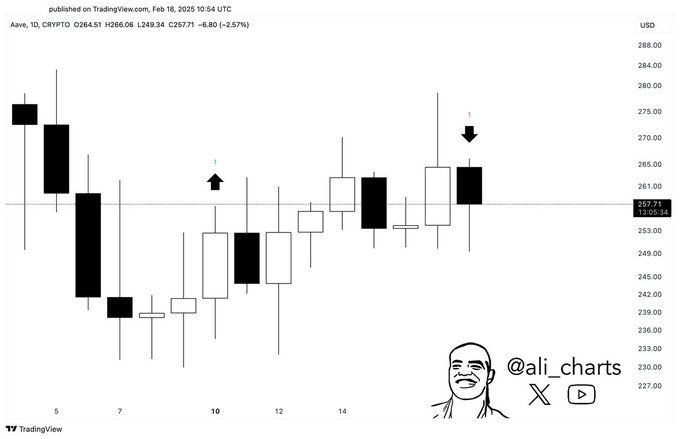

While bulls fight for control, AAVE remains poised for continued struggle after resistance rejection.

AAVE failed to steady above $270 after rallying to $277 on Monday.

The sharp rejection saw the alt plunging to $249 the following day.

Despite recovering to $254 at press time, popular analyst Ali Martinez highlighted potential pullback as the daily chart displayed selling signs.

AAVE’s dip to $249 after rejection confirmed intensifying selling momentum.

The chart shows multiple black candles printed lower lows and lower highs following the latest price decline.

Nevertheless, a white candle appeared on 10 February, hinting at potential bullish recoveries.

White and black candles alternated as prices entered a consolidation period.

The daily chart shows the price soared with lower highs and higher highs to hit the $270 resistance.

However, AAVE suffered a sharp rejection after a black candle with a longer upper wick appeared.

The two levels marked by arrows signal a trend shift.

The first arrow on 10 February matches the white candle, indicating a momentary buyer comeback.

The other arrow stands at a resistance mark, with a black candle following a massive white one.

Such developments confirm market indecision.

However, AAVE mirrors the prevailing sentiments in the crypto market, where bears are restricting upside actions.

Experts forecast continued consolidations and underperformances until Bitcoin breaks the $100K mark.

Such a move would trigger notable resurgences within the altcoin market. AAVE looks ready to outperform amid broad-based rallies.

AAVE ecosystem still strong

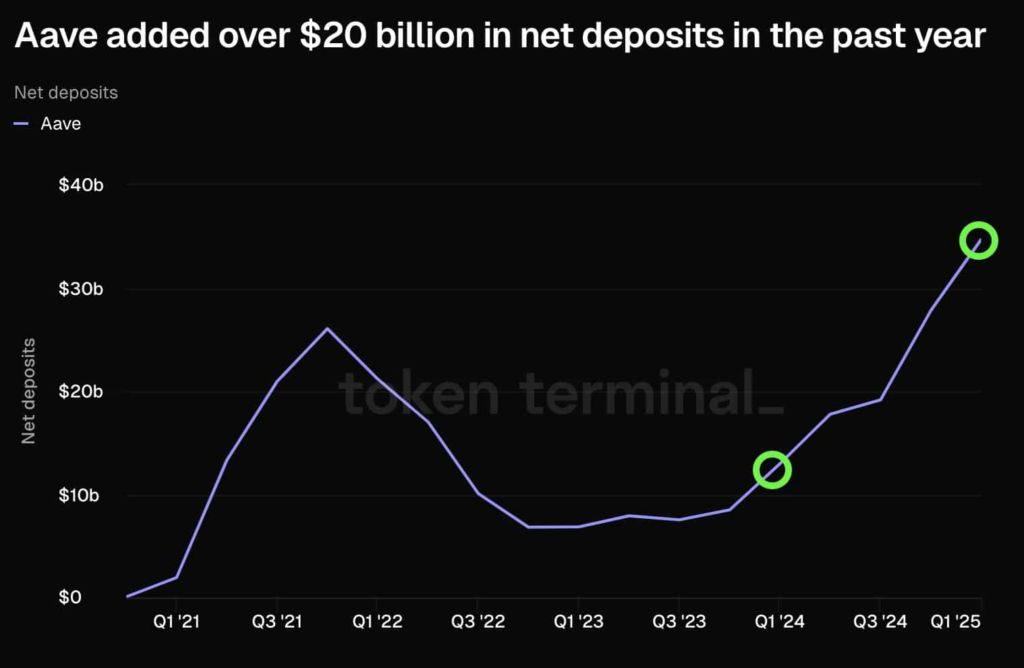

Token Terminal data shows AAVE added more than $20B in net deposits within the past year.

That signals massive cash entering the alt’s ecosystem, reflecting investor confidence in AAVE.

The influx in capital would be crucial for sustained uptrends amid breakouts.

Moreover, Ava Labs proposed using GHO as a gas token to allow predictable gas fee pricing in cost-friendly platforms.

The framework outlines how a native bridge operates as the liquidity pool for GHO minting, embedding security and liquidity management into the network’s infrastructure.

Further, AAVE sees increased attention from institutional players.

For instance, the Ethereum Foundation deposited ETH worth approximately $26.74 million (10,000 ETH) into AAVE.

EF Treasury has deployed:

– 10,000 ETH into Spark

– 10,000 ETH into Aave Prime

– 20,800 ETH into Aave Core

– 4,200 ETH into Compound

We’re grateful for the entire Ethereum security community that has worked diligently to make Ethereum DeFi secure and usable!

That demonstrated unwavering institutional trust in the liquidity protocol, cementing its position in the DeFi world.

The massive deposit from a leading player in the crypto industry (the Ethereum Foundation) might bolster institutional interest in AAVE in the coming times.

AAVE price outlook

The alt trades at $254 with modest gains on its daily and weekly chart.

The nearly 20% decline in 24-hour trading suggests weakness and possible downsides.

With the prevailing indecision, AAVE’s trajectory depends on its performance around the support at $249.

Breaching this mark could trigger relentless dips or extended consolidation.

However, enthusiasts should follow broad market developments to determine AAVE’s possible direction in the upcoming times.

Analyst Michael van de Poppe advised holding amid the current uncertainty.

Volatility on #Altcoins is still insane.

Sentiment is super negative.

We’re in a weird vacuum where the old narrative dies, the new narrative starts to slowly wake up.

If you’re in those altcoins, utility coins. Hold. Your time is about to come.

Cryptocurrencies are underperforming due to the unpredictable global economic landscape and negative sentiments amid incidents such as LIBRA’s scam.

The post AAVE under pressure: resistance rejection fuels selling momentum appeared first on Invezz