Newton Gitonga

Cryptocurrencies traded in red on Tuesday as bears triumphed amidst the prevailing macroeconomic woes.

Let’s check Solana, Pi Network, and Cardano’s near-term structures and what to expect in the upcoming sessions.

Solana revenue hits record lows

Solana led crypto gainers early in 2025 as meme token activities dominated its ecosystem.

The buzz saw its weekly revenue skyrocket to $55.3 million in January.

However, Solana has struggled in the past two months.

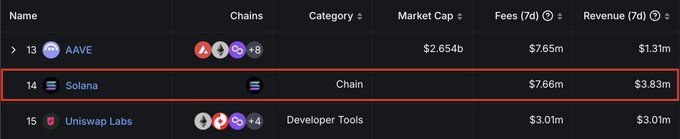

DeFiLlama data shows SOL’s weekly revenue plummeted 93% to approximately $4 million last week.

JUST IN: SOLANA REVENUE DROPS BY 93%, FROM $55.3M IN MID-JANUARY TO JUST $4M LAST WEEK.

Source: @DefiLlama

The staggering decline in revenue matches the faded interest in meme tokens in recent times.

Themed tokens have lost appeal in the cryptocurrency sector due to scam allegations.

Recent incidents such as massive losses from Donald Trump and Javier Milei’s meme scandals dented interest in these assets.

These trends have catalyzed significant SOL price underperformance lately.

It trades at $124 after last week’s 10% dip extended monthly losses to 40%.

Pi Network loses momentum ahead of token unlocks

Pi Network has dominated cryptocurrency chatter lately.

While it defied expectations with consistent gains after the 20 February official mainnet launch, PI has weakened in the past few sessions.

The altcoin has lost nearly 55% from its all-time high of $2.95 to trade at $1.36 during this publication.

Broad market weakness and user frustrations amid failed token migrations have crashed PI in the past sessions.

Moreover, market players remain on the sideline as the project braces for massive token unlocks.

PiScan data shows Pi Network will release assets worth $18.11 million (9.05 billion Pi) daily in the next month.

Meanwhile, the unlocks will increase to $46.27 million (23.1 million PI) on 17 March and $46.88 million (23.4 million tokens) on 21 March.

These events will likely catalyze notable selling momentum for Pi Coin (in the near term).

Failure to weather the imminent storm could see the altcoin losing the $1 psychological mark.

Meanwhile, the much-anticipated Pi Day (14 March) remains pivotal for the project.

Enthusiasts expect bullish announcements from developers on this day.

$Pi price will pump in the next 3 days (Pi Day) if you’re wise buy now and make a huge profit on 3.14.25🔥🔥

Stability above the $1.05 barrier could invalidate the prevailing bearish setup and trigger rebounds toward $3.5.

Cardano’s potential bounce-back

ADA lost around 75% after hitting $1.14 on 2 March, reentering the $0.70 territory.

While the sharp retracement signals robust bear influence, ADA-BTC displays optimism, indicating a potential market shift to large-cap cryptocurrencies.

Furthermore, Cardano’s weekly chart reflects the 2021 rally, when consolidations followed a 50% price dip before ADA surged 4,000% to $3.10.

The altcoin trades at $0.7210, down 2% and 9% in the past day and week.

Amidst the prevailing bear dominance, ADA could experience significant consolidations beneath $1.

That might welcome a bear trap in the upcoming sessions.

That might catalyze short-seller liquidations amidst possible shifts in broad market conditions.

Such development might see ADA repeating its 2021 performance.

Popular analyst Ali Martinez supported this narrative with his latest X post.

Looking back at history, #Cardano $ADA seems to be repeating the same pattern from 2020 to 2021 at a slower pace, which could soon lead to a parabolic rally!

Go to @SimpleFXcom via my link sfx.unilink.io/ali, claim the $5,000 bonus, and get some before it’s too late!

Nevertheless, robust recoveries in the cryptocurrency market remain crucial for such a move.

Sellers dominate the industry, suggesting extended pain before possible recoveries.

The post Altcoin update: Solana’s revenue plummets 93%, Pi Network unlocks, and ADA’s bear trap appeared first on Invezz