Newton Gitonga

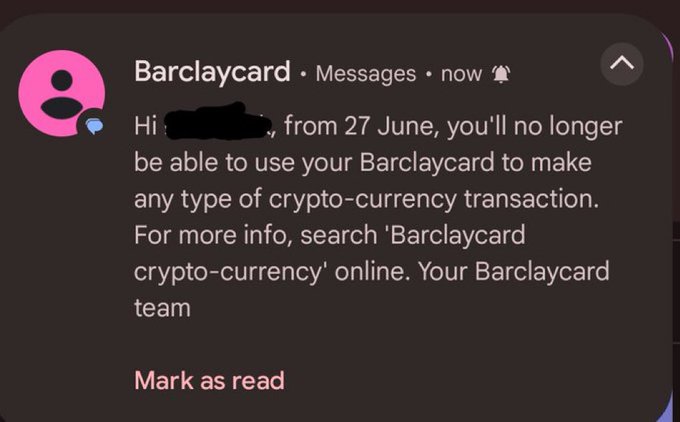

United Kingdom’s Barclay Bank has confirmed that clients will no longer access crypto features from the Barclaycard starting 27 June 2025.

The move underscores the rising concerns over financial risks linked to cryptocurrency purchases, especially with the industry’s unpredictable nature.

Barclays Bank cited digital asset volatility, which can lead to massive debts upon significant price dips.

Moreover, it highlighted the security risks, with blockchain’s anonymity making it hard to reverse transactions once executed.

According to the official statement:

We are doing this because a fall in the price of crypto assets could lead to customers finding themselves in debt they can’t afford to repay. There’s also no protection for crypto assets if something goes wrong with the purchase, as they’re not covered by the Financial Ombudsman Services and Financial Services Compensation Scheme.

JUST IN: 🇬🇧 Barclays is banning customers from using their card to make “any type of cryptocurrency transaction”

Mounting concerns over client safety and debt

Barclay’s move comes amid increased integration of digital assets into our day-to-day lives.

More retail participants, many lacking financial understanding of debt, are joining the craze to partake in speculative trading.

The bank believes its customers are vulnerable to debt after impulsive digital asset purchases, especially during wild market volatility.

Meanwhile, the decision reflects the current trend in traditional finance, where banks explore various steps to reduce exposure to cryptocurrencies.

Besides volatility, Barclays Bank emphasized the debt risks that clients could incur.

Customers can fail to pay what they borrowed to spend on unexpected value declines in digital assets, which is common in the crypto industry.

Adding to the concerns, the sector lacks solid safety nets.

Unlike traditional fiscal products, digital currencies fall outside the Financial Services Compensation Scheme or the Financial Ombudsman Services.

Incidents such as erroneous transactions or exchange collapses can mean massive losses, as there’s no institutional protection when interacting with cryptocurrencies.

What it means for crypto investors

Barclay’s updated terms will likely disrupt funding options for customers who use Barclaycard to transact crypto.

While credit cards have proven convenient for buying tokens like BTC and ETH, the bank will close that path this week.

It’s not possible to make crypto-currency transactions using a Barclaycard. From 27 June 2025, we’ll block crypto-transactions made with a Barclaycard because we recognize there are certain risks with purchasing crypto-currencies.

Nevertheless, this limitation only applies to Barclaycard. Interested individuals can still access cryptocurrency platforms through e-wallets, bank transfers, and other non-card options.

Barclays isn’t against crypto ownership, but only blocks purchases completed using borrowed money.

This policy change sees Barclays joining the ranks of other significant financial players, including Lloyds, Virgin Money, JPMorgan, and Citigroup, which have similarly moved to limit crypto transactions via credit.

That’s a solid reminder that monetary stability is paramount in financial innovations.

Meanwhile, the bank has urged people to visit the Financial Conduct Authority website to familiarize themselves with the risks associated with digital currencies.

The post Barclays Bank blocks crypto-related card transactions over debt concerns appeared first on Invezz