Collins J. Okoth

U.S. spot Bitcoin exchange-traded funds have emerged in the spotlight after recording $242.53 million in negative flows. BlackRock’s IBIT is the only BTC ETF that recorded positive flows amid the outflows. Ethereum ETFs also recorded net outflows worth $48.52 million on October 1st.

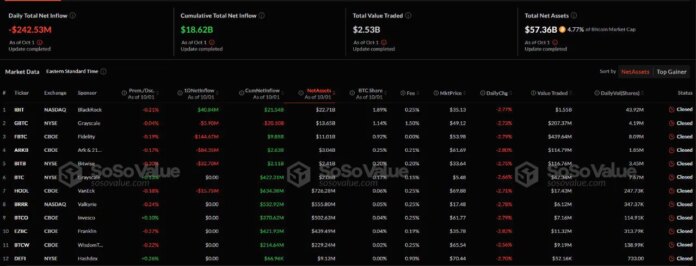

October’s start has been rocky for Bitcoin and Ether U.S. spot ETFs. The rocky start saw Bitcoin ETFs register outflows worth $242.53 million. The cumulative total net inflow of BTC ETFs currently sits at $18.62 billion as of October 1st. The total value traded on the day was $2.53 billion.

IBIT ETF records positive flows

According to Sosovalue, BlackRock’s iShares Bitcoin Trust (IBIT) is the only fund that recorded net inflows. The fund registered inflows worth $49.84 million. The figures brought its cumulative net inflow to $21.54 billion. IBIT’s inflows recorded on October 1st dropped from $72.2 million registered on September 30th. On a lighter note, the fund has sustained positive flows for seven consecutive days starting from September 23rd.

Grayscale’s GBTC, Ark & 21Shares’ ARKB, Fidelity’s FBTC, Bitwise’s BITB, and VanEck’s HODL recorded negative flows yesterday. FBTC registered the most outflows compared to other funds. The ETF saw $144.67 million in outflows. The flows marked a significant drop from $8.3 million in inflows registered the previous day.

ARKB trailed behind FBTC with total net outflows worth $84.35 million. BITB followed with outflows worth $32.70 million. VanEck saw outflows worth $15.75 million, while Grayscale’s GBTC registered negative flows worth $5.90 million.

Grayscale’s BTC, Valkyrie’s BRRR, Invesco’s BTCO, Franklin’s EZBC, Hashdex’s DEFI, and Wisdom Tree’s BTCW did not register any flows. The total net assets under the custody of all spot BTC ETFs represent 4.77% of the total BTC market cap valued at $57.36 billion.

ETH ETFs cement a two-day streak with $48.52 million in outflows

Ethereum ETFs also faced turbulence on October 1st after recording $48.52 million in outflows. The flows brought their cumulative total net outflows to $572.31 million. The outflows on October 1st marked a two-day streak of negative flows. The total value traded for all transactions on all spot Ether ETFs stood at $290.81 million at the time of this publication.

Only VanEck’s ETHV and 21Shares’ CETH registered net inflows. ETHV received inflows worth $2.74 million as CETH received $1.25 million. Grayscale’s ETHE recorded the largest outflows worth $26.64 million. Fidelity’s FETH followed closely behind, with net outflows turbulating to $24.97 million. Bitwise’s ETHW registered the smallest outflows worth $895.65k.

BlackRock’s ETHA, Grayscale’s ETH, Franklin’s EZET, and Invesco’s QETH did not register any flows. Fidelity’s FETH has the largest cumulative net inflow figure among all Ether ETFs, sitting at $453.67 million. The fund is closely followed by Bitewise, with a cumulative net inflow worth $325.78 million at the time of this publication.

The total net assets under the custody of spot Ether ETFs equate to 2.31% of the asset’s market cap valued at $6.81 billion.