Lockridge Okoth

According to analyst Raoul Pal, Bitcoin (BTC) could soon record a new all time high. He cites three catalysts that provide tailwinds, marking the beginning of a “Macro Summer.”

On Monday, Bitcoin reclaimed $70,000, a brief test of levels last seen around mid-June.

Bitcoin Poised for New ATH

The popular analyst anticipates a breakout in the Bitcoin price to a new ATH amid improving macroeconomic conditions. Pal indicates a “giant cup and handle” pattern, which, when broken, could send BTC to the “Banana Zone” — a period of significant upward price movement.

“Macro Summer is beginning to take hold and should last at least for the rest of 2024 and into 2025…Bitcoin is ready to soon break the giant cup and handle and head into the Banana Zone,” Pal wrote.

Pal observes a possible “healthy correction” in the Nasdaq (NDX). Some investors turn to alternative assets like Bitcoin during a correction in traditional markets like the Nasdaq. This is a common strategy to diversify their holdings, spread risk, and potentially offset losses in the stock market.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Bitcoin presents itself as a safe-haven asset similar to gold. This perception can drive up demand for BTC and other cryptocurrencies amid market uncertainties, leading to price increases during a Nasdaq correction.

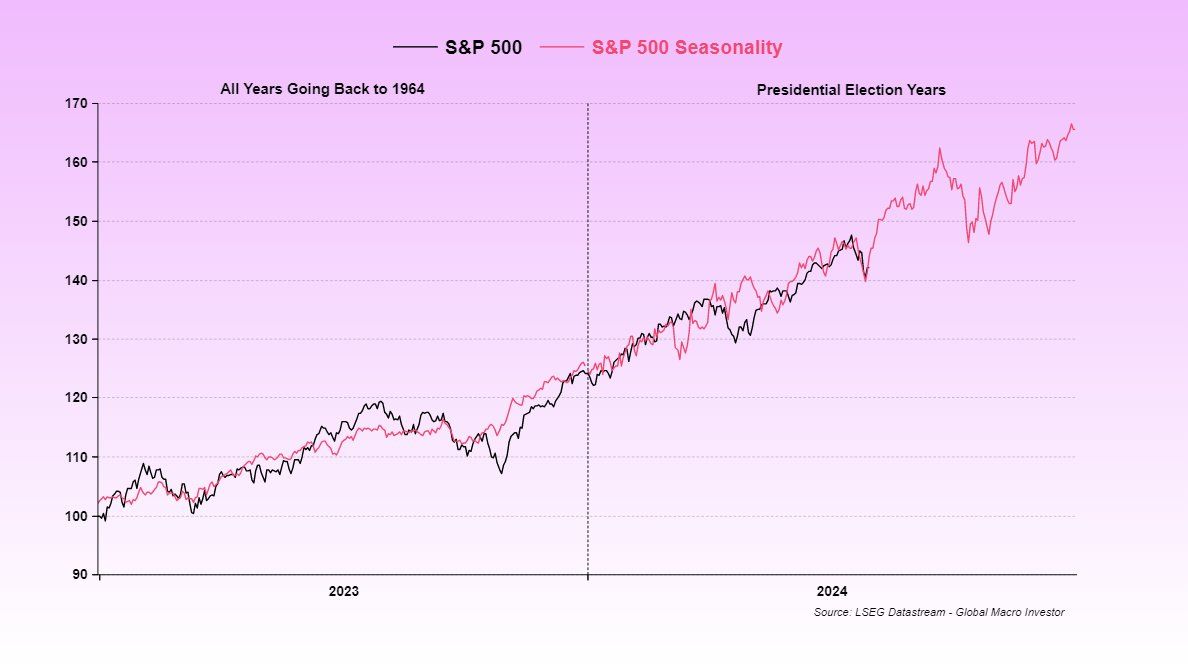

The US election is another catalyst that could send Bitcoin to a new ATH. “It’s perfect timing during election years,” Pal says, referring to price performance based on history.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Governments often introduce economic stimulus measures to boost the economy and improve sentiment before an election. This influx of capital can benefit both traditional and alternative assets.

Despite this assumption, it is imperative to note that each year and election cycle can bring unique circumstances that may influence market performance differently.

The founder and CEO of Global Macro Investor also highlighted the potential for a weaker US Dollar, which “could ease financial conditions further.” With Bitcoin often considered a hedge against inflation, a weaker US dollar could raise concerns about rising inflation. Investors may turn to alternative stores of value like Bitcoin to protect their wealth against the potential loss of purchasing power due to inflation.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

With tailwinds from the three events, Pal predicts a new peak for Bitcoin and gold through 2024 and into 2025.

“This confluence of events may take a little more time to play out or could happen with the FOMC. Who knows… but good times lie ahead. Enjoy Macro Summer,” he noted.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.