Nellius Irene

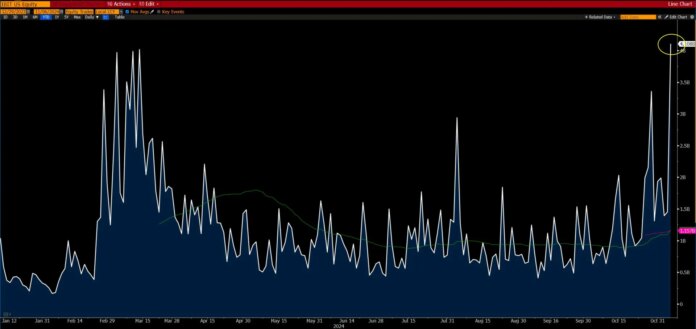

After Trump’s election victory, Blackrock’s IBIT realized an exponential increase in trade volume, with over $4.1 billion traded on November 6. Eric Balchunas, a senior ETF analyst at Bloomberg, said trading volume on IBIT was up by 10% and higher than the volumes for stocks like Berkshire, Netflix, or Visa.

Blackrock’s IBIT saw its second-best day since its release

Blackrock’s Bitcoin ETF saw a record surge in its trading volume soon after Donald Trump’s election victory. The ETF had over $4.1 billion traded, which proved to be larger than what some other stocks saw.

Eric Balchunas, on X, posted this incredible achievement calling it the “biggest volume day ever” for IBIT. He said:

It was also up 10%, its second-best day since launching. Some of this will convert into inflows likely hitting Tue, Wed night.

-Eric Balchunas

Blackrock was not the only ETF trader with impressive trading volume. According to Balchunas, Bitcoin ETFs traded $6 billion collectively, the highest since the “crazy early days” in January. He added that most of these ETFs traded two times more than their average, tagging it an all-day banger for these ETFs.

Even Bitcoin’s price surged, hitting a new all-time high of $76,500 on November 6. Currently, Bitcoin is trading at $74,802, a slight 2.2% fall from its peak the day before.

Trump’s win had some of the iShares ETFs falling

Following Trump’s win and his pledge to introduce favorable crypto policies, crypto analysts are optimistic about gains for other digital assets in the U.S., not just Bitcoin.

However, some popular iShares ETFs in South Korea, Hong Kong, Taiwan, and Chile slid on Wednesday despite major U.S. indexes soaring to record highs. This shows that while the US crypto market may boom, the same may not apply to the international markets.

Beyond the global crypto markets, all other stocks may be affected, especially since the president-elect has promised to raise taxes on all imports, particularly those from China.

According to Yung-Yu Ma, chief investment officer for BMO Wealth Management, while the U.S. investment landscape continues to look positive, global markets remain particularly susceptible to tariff policy, which could hinder the upside for international equities in the near term.