Newton Gitonga

Digital assets displayed bullishness on Thursday as Bitcoin crossed $100,000 again, currently trading at $101,381.90.

While BTC’s rebound triggered significant uptrends in the altcoin space.

Meanwhile, Goatseus Maximus (GOAT) and Chainlink stirred the crypto community for various reasons. Let us find out more.

US CPI data fuels Bitcoin rebound

Cryptocurrencies soared today following the United States CPI inflation, reading 2.7%.

Bitcoin jumped from the daily low of $97,174 to $101,870 after a 4% upswing.

The November US inflation data matched the expectations of policy changes by the Fed.

The developments renewed institutional attention in the top cryptocurrency, propelling it above the $100,000 psychological mark.

Bitcoin’s jump has triggered speculations about its future potential, with analysts forecasting more gains amidst favourable economic conditions.

Analyst Michael van de Poppe believes Bitcoin can hit new all-time highs in the coming days.

The crucial level is still defined on $BTC.

If the markets stay above that area, it’s likely that we’ll see new ATH’s in the coming days.

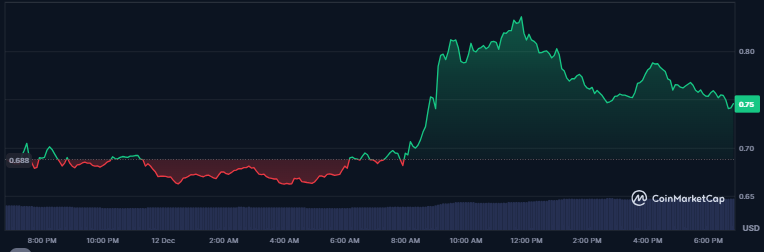

Goatseus Maximus leads altcoin recovery

GOAT attracted the crypto community’s interest as its swift 24-hour price surge to $0.8353 opened the gates to the $1 billion market cap.

Though it dropped slightly from the daily peaks to $0.7540, the alt exhibits notable upside momentum.

The 30% uptick in daily trading volume to $518 million underscores significant investor attention behind GOAT’s price movements.

OKX’s announcement contributed to the altcoin’s outperformance over the past 24 hours.

The crypto exchange confirmed that it will list GOAT on December 12 and welcomed its users to start trading the token the same day.

Technical indicators support the recovery mode.

The 4H MACD has made a bullish crossover with the signal line, while the Relative Strength Index at 59 signals more steam for GOAT’s uptrend.

The current momentum could propel the cult coin above $1 and record new ATHs (in the near term).

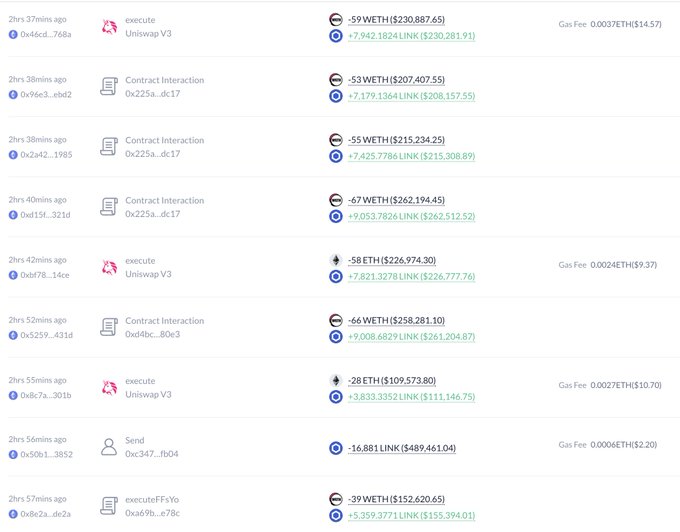

Chainlink rallies on institutional interest

LINK price attained a new milestone today, triggering excitement and predictions of further gains.

Interest from large-scale investors drives Chainlink’s performance.

Trump-affiliated World Liberty Finance (WLFI) spent millions to acquire Ethereum, AAVE, and Chainlink.

Blockchain data shows Trump’s project used 1 million USD Coin (USDC) to purchase 41,334 LINK assets, spending $24.2 per token.

The news triggered a significant 30% surge to $26. Meanwhile, the trend continued, according to Lookonchain findings.

Whales are buying $LINK!

A whale spent 1,263 $ETH($4.94M) to buy 175,424 $LINK at $28.18 in the past 5 hours.

debank.com/profile/0x15b2…

The blockchain analytics firm revealed another whale that scooped 175,424 LINK tokens at $28.18 average price.

The investors spent Ethereum worth 44.94 million (1,263 ETH) to complete the transaction.

Furthermore, Santiment highlighted that whale addresses holding over 100,000 LINK assets have accumulated Chainlink in the past two months.

Such trends reflect investor confidence in LINK’s future price movements.

Meanwhile, experts predict massive gains for digital assets as Trump’s leadership promises a favorable environment for crypto success.

Enthusiasts will likely watch how the incoming US government will shape the cryptocurrency industry in the coming years.

The post Crypto today: BTC steadies above $101K, GOAT soars 30%, LINK’s robust whale interest appeared first on Invezz