Newton Gitonga

Cryptocurrencies dominate the global financial space with relentless surges. Amidst the optimism, attention turned to individual coins, with mixed actions.

Meanwhile, Solana, SUI, and the new $QUANT stole the show for different reasons. Let us find out more.

Solana targets further gains

The alt hovers above $250 during this writing, exhibiting significant bullish momentum.

SOL remains among the top altcoins this cycle, with its latest performance threatening Ethereum dominance.

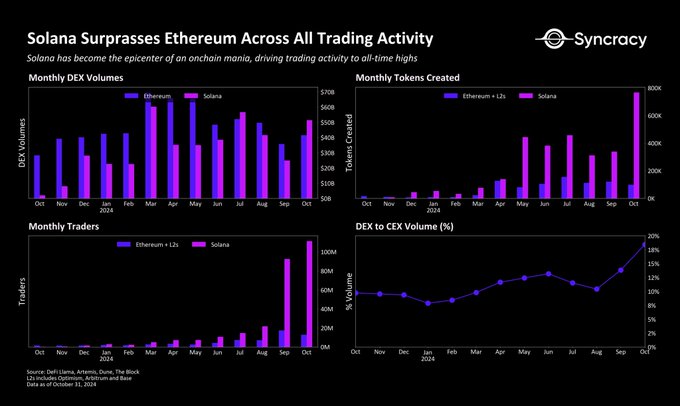

Solana topped charts over the past few months, outshining Ethereum in DEX volumes and daily fees.

DeFiLlama data show Solana accumulated $11.8M in daily fees, eclipsing Ethereum’s $5.3M.

Also, Solana reported a whopping $6.24B in daily DEX volume, far from ETH’s $850M.

Such performance contributed to SOL’s price stability, up over 300% YTD.

The alt exhibits immense bullish strength, and the 39% increase in 24-hour trading volume supports the expected 40% increase to $350.

Syncracy Capital’s Ryan Watkins stated that Solana’s strength lies in demonstrating its developments, not speculations.

Solana is winning because of its fast transactions, low-cost asset creation, and seamless mobile access.

These are important advantages given that nearly every blockchain use case is derivative of sending, exchanging, and intermediating the relationships between assets.

He added that low-cost token creation (which contributed to the Solana meme coin boom), seamless mobile access, and fast transactions.

Network outage shakes SUI ecosystem

Sui attracted the crypto community’s attention on Thursday following a two-hour network downtime.

The Sui network is back up and processing transactions again, thanks to swift work from the incredible community of Sui validators.

The 2-hour downtime was caused by a bug in transaction scheduling logic that caused validators to crash, which has now been resolved.

The outage, which saw the L1 blockchain failing to process transactions, resulted from a bug.

Meanwhile, SUI has demonstrated resilience since launching in May 2023.

SUI saw remarkable price uptrends recently, hitting new all-time highs amidst bullish broad market sentiments.

That catalyzed a 55% monthly increase in its total value locked (TVL) to $1.6 billion (DeFiLlama data).

Meanwhile, today’s outage catalyzed bearish price actions, plunging SUI to $3.36. However, it has since recovered to $3.63 at press time.

Perceived a Solana killer due to its priority on quick transaction finality, SUI’s latest outage mimics Solana past issues.

For instance, Solana suffered five downtimes since 2022, with the latest in February 2024.

Community backup thwarts QUANT swindle

A teen trader dumbfounded digital assets enthusiasts after pulling an exit scam on his coin, QUANT.

He netted $30K, 128.3 SOL tokens, in front of his viewers.

The Genz used Pump.fun to launch the token, potentially to capitalize on the ongoing hype about Solana-based memes.

However, there was a turn of events, as what began as a scam materialized into a money-making opportunity.

The crypto community, energetic and determined, propelled the altcoin’s market capitalization to $75M within hours.

Furthermore, increased interest in the token saw QUANT rallying by around 71,380% within six hours. That welcomed new all-time peaks of $0.07876.

However, remarkable declines, usual after explosive gains, had QUANT lose over 50% on its daily chart to trade at $0.01006 – a staggering 87% plunge from ATHs.

Lookonchain revealed that the scammer continued his game, netting $24K (103 SOL tokens) after creating and dumping Sorry and Lucy tokens.

Meanwhile, the community remains determined to hold the teen accountable. They have tracked his sensitive details, including his family, school, name, and address.

The $Quant kid’s family have been doxed and tokenised.

Welcome to Quant Ecosystem.

Crypto is weird sometimes.

The post Crypto today: SOL targets 40% surge, SUI faces network outage, teen’s failed QUANT rug pull appeared first on Invezz