Newton Gitonga

Curve DAO (CRV) has extended its weekly gains by 145% after surging more than 40% in the past 24 hours.

Tuesday’s statement of Curve’s stablecoin scrvUSD launch on Spectra triggered the ongoing bullish wave.

Yield markets are very very important, and for Savings crvUSD @spectra_finance is one of the first to go up

news.curve.fi/spectra-financ…

Curve DAO is a DEX for stablecoin that utilizes an AMM (automated market maker) to control liquidity.

Meanwhile, its newly launched Savings-crvUSD yield-bearing stablecoin went live on the Spectra network yesterday.

Savings-crvUSD provides low-risk investor returns and aids in crvUSD scaling, drawing more participants to the Curve platforms. The recent announcement indicated:

Spectra uses Curve’s Cryptoswap AMM algorithm, where CurveDAO earns 50% of all fees generated by liquidity pools on Spectra. Spectra is an example of Curve’s AMMs being utilized in the yield-trading ecosystem, a part of DeFi popularized by Pendle.

Launched on 3 December, stablecoin scrUSD has gained notable popularity, attracting deposits worth over $14.5 million.

The new product underscores Curve Finance’s dedication to enhancing the adoption and scalability of the crvUSD stablecoin.

By integrating scrvUSD into the Spectra network, the DEX targets increased decentralized finance (DeFi) products and more users to join the CRV blockchain.

CRV price performance

The token trades at $1.19 after gaining over 40% the previous day. It touched the $0.8512 daily low and a $1.21 24-hour peak.

The robust daily trading volume, up 35% within the past day, suggests a healthy environment for continued upswings.

Besides the stablecoin developments, on-chain stats support the altcoin’s upward stance.

CRV’s staking has skyrocketed from 27 November’s $445.3 million to $839.3 million on 4 December – hitting the highest mark since June 2022.

The surging staking confirms more players actively engaging with the Curve blockchain, highlighting increased adoption.

Moreover, the CRV chain experiences an uptick in liquidity and trader interest.

According to Artemis data, Curve’s 24-hour trading volume exploded to $1.6 billion yesterday, exploring values never seen since the asset’s 2020 launch.

CRV eyes another 33% increase

The latest upsurge saw CRV breaking above the plunging trendline formed by connecting several weekly peaks from July 2022.

The bullish move intensified early this week, catalyzing a more than 145% gain till today.

CRV reclaimed the 50% FIB retracement mark of $0.88, and bulls target a retest of the July 2022 peak at $1.58.

Attaining this goal would mean a 32.77% price increase from current values.

Nonetheless, caution remains paramount as the Relative Strength Index at 83.43 (on the 4H chart) confirms overbought situations.

That positions CRV for potential dips before anticipated highs.

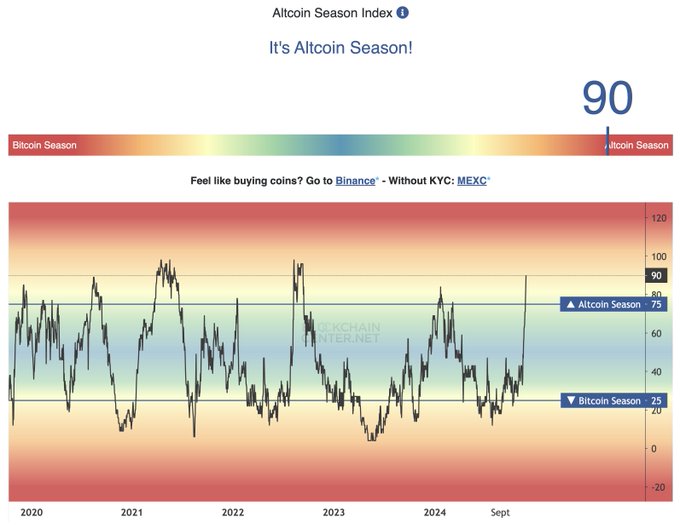

Meanwhile, the underway altcoin season indicates that any dips might be short-lived.

The alt season index has hit levels never seen since 2022, suggesting continued outperformance in the altcoin sector.

Wow.

This is the highest the Altcoin Season index has been since 2022.

We’ve been waiting for this for years!

The broad market has exhibited significant optimism since Donald Trump’s victory.

The prevailing sentiments support bullish rallies for digital assets in the coming months.

The post Curve Finance price surges with scrvUSD launch on Spectra appeared first on Invezz