Newton Gitonga

Cryptocurrencies displayed mixed trends on Monday as altcoins signaled recoveries while Bitcoin remained stuck around the $97K region.

Amidst the indecisive performance, DeFi tokens thrived with substantial gains.

While the global crypto market capitalization lost nearly 1% to $3.12 trillion, the value of all DeFi tokens surged 18% in the past day to surpass $132 billion.

DeFi cryptocurrencies have outperformed meme tokens, which have led market rebounds in previous cycles.

Themed tokens traded in the red as PolitiFi tokens confirm experts’ concerns, crashing harder in the past day.

Altcoins linked to political figures have crashed over the past day due to the latest pump-and-dump project, which forced lawmakers to consider impeaching Argentina president.

The prevailing trends, where DeFi outperforms meme tokens, signal a market shift as enthusiasts begin focusing on projects with real-world use cases.

CAKE gains 70% in a week: what’s next

CAKE has been on investors’ radar over the past few sessions due to PancakeSwap’s role in BNB Chain’s restoration.

The altcoin trades at $2.70 following a 4% dip on its daily price chart – a normal dip after a massive uptrend.

CAKE exhibits a long-term bullish trajectory.

According to analyst AMCrypto, CAKE might plunge from the current levels to retest the $2.2 – $2.4 range before exploding higher.

$CAKE Price Update 🚨

– Pumped 200% in a few weeks

– Retest of $2.2-$2.4 is highly likely

– Expecting $5-$6 before April 2025

He expects the alt to soar towards $6 in the coming months.

The weekly chart supports expected upswings.

The token has traded under an impressive bull influence since bouncing back from $1 in the fourth quarter of 2024.

PancakeSwap’s native token targets a breakout to $4.6 on the seven-day chart.

That would mean a 70% increase from the current price of $2.71.

Chainlink: reduced volatility signals more gains

LINK trades at $19.49 after gaining over 3% and 5% in the past day and week.

The robust daily trading volume suggests renewed trader optimism, which could propel price further.

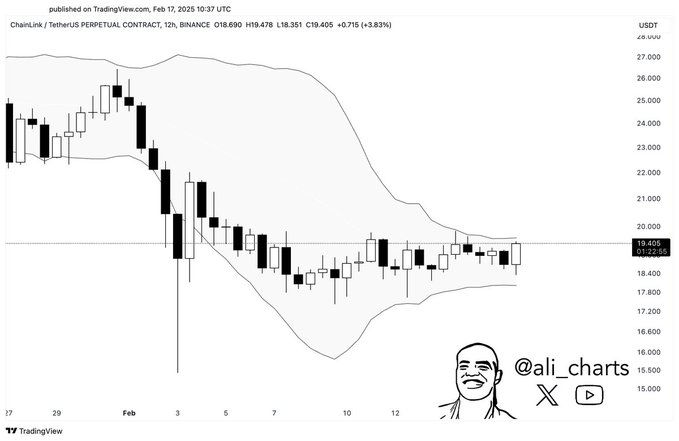

Chainlink experienced low volatility, a situation that often precedes bullish price actions.

Ali Martinez highlighted squeezing Bollinger bands on LINK’s 12-hour chart, indicating reduced volatility.

That positions Chainlink for a massive price move. But in which direction?

LINK’s current outlook indicates fewer hurdles for the upside path.

Meanwhile, $19 serves as Chainlink’s key support.

Stability above this region would support surges to the resistance at $22.

That can open the doors to $25 before LINK soars to mid-December highs above $30.

However, weakness at $19 might catalyze price dips to $17.31.

Breaching this foothold will invalidate the highlighted bullish trajectory and trigger continued downsides or extended consolidations.

Chainlink is among the most stable projects in the crypto world, testified by its significant adoption.

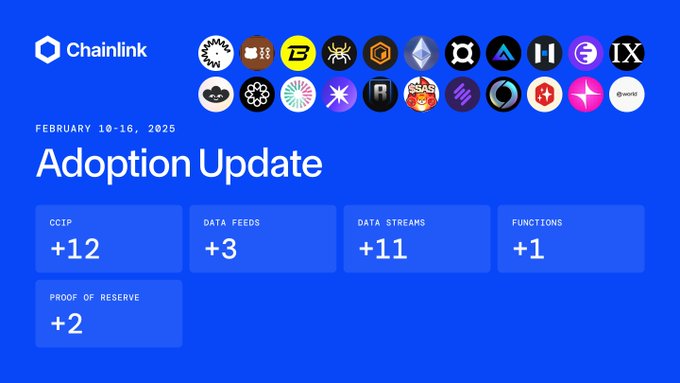

The project saw nearly 30 integrations within the past seven days.

⬡ Chainlink Adoption Update ⬡

This week, there were 29 integrations of the Chainlink standard across 5 services and 21 different chains: Arbitrum, Astar Network, Base, Berachain, Blast, BNB Chain, Botanix, Core, Ethereum, Fraxtal, HashKey Chain, Ink, Lens Chain, Mantle, Merlin…

Increased adoption positions LINK for massive growth and will likely influence stable price performance in the future.

The post DeFi tokens CAKE and LINK lead market rebound as meme coins lag appeared first on Invezz