Newton Gitonga

Cryptocurrencies saw significant gains in the past day as Bitcoin approached the vital $90K.

Ethena (ENA) capitalized on the bullish sentiments to extend its weekly gains by around 10%.

The impressive recovery made most ENA holders profitable, according to IntoTheBlock data.

While the altcoin targets further gains, massive sell-offs by Donald Trump-linked World Liberty Financial raised eyebrows.

On-chain analytics platform Arkham shows WLFI sold ENA worth approximately $69,000 (184,000 tokens) within the past 24 hours.

Attention shifted to the altcoin’s performance, which demonstrated amplified volatility amidst the rising selling momentum.

Trump’s World Liberty books ENA profits

While digital assets rallied over the last 24 hours, World Liberty Financial saw an opportunity to take profits.

The 184K token dump triggered speculations about ENA’s price movements.

The transaction meant increased selling momentum and institutional disinterest in the altcoin.

WLFI dumped Ethena after adding Mantle worth $3 million into its holdings.

Thus, Ethena’s sell-off grabbed attention, especially during magnified profitability.

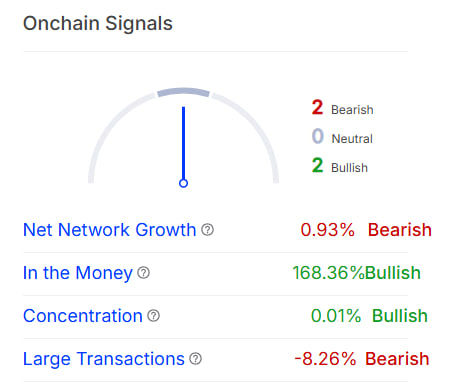

ENA started flipping its structure to bullish following the latest rebound, confirmed by mixed indicators.

The “In the Money” indicator highlights ENA’s increased profitability, with most holders profitable at current prices.

The 168.36% reading shows most Ethena investors purchased at lower prices than the current market value.

As individuals are less likely to offload at the onset of profits, WLFI’s move indicated reduced trust in ENA’s upside momentum.

Nevertheless, the increased concentration shows that top Ethena investors are keeping their stash.

The 8% decline in large transactions suggests reduced optimism from whale players, while plunged network growth indicates new participants’ unwillingness to interact with Ethena.

Meanwhile, Ethena’s unlock schedule might force investors to quit to reduce losses amid amplified volatility.

Over 2 billion ENA tokens flooded the market in March, and the project awaits to unlock over 200 million tokens in April first week.

Meanwhile, the WLFI’s move matches the prevailing market trends.

Ali Charts highlighted that whales offloaded over 20,000 BTC following the recent rally.

ENA price outlook

The alt gained over 3% in the past 24 hours to hover at $0.4061 at press time.

The increasing daily trading volume suggests continued uptrends in the near term.

The digital coin touched a daily low and high of $0.3883 and $0.4099, highlighting notable volatility.

While the prevailing outlook suggests continued gains, looming selling pressure suggests short-lived rallies.

Meanwhile, broad market sentiments could shape Ethena’s trajectory in the near term.

Bitcoin trades at $86,700 after failing to break $90K.

Bulls appear exhausted after the latest push to $88K, indicating possible declines below $85K in the coming sessions.

Such trends might magnify ENA’s selling pressure, weakening the upside momentum.

The post Ethena price forecast: Trump’s World Liberty Financial takes profits after ENA’s 10% rally appeared first on Invezz