Andreja Stojanovic

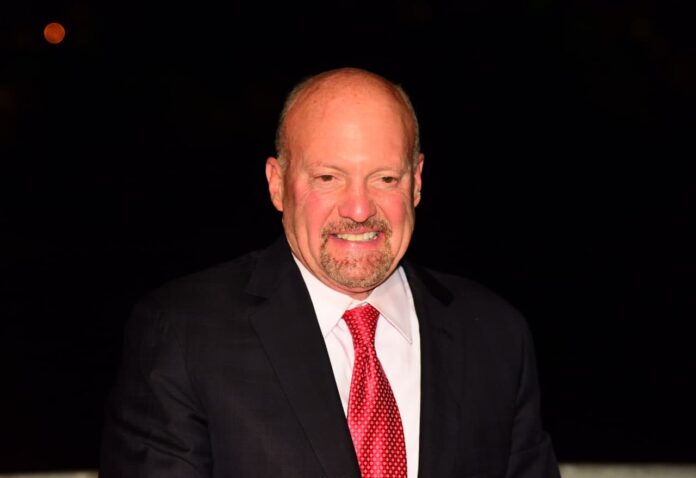

The former hedge fund manager, energetic host of CNBC’s ‘Mad Money,’ and something of a meme within investment circles on X, Jim Cramer, outlined what he considers one of the biggest dangers for U.S. stocks as 2024 moves deeper into its final months.

According to Cramer, investors may be overestimating the odds of the U.S. Federal Reserve (Fed) cutting interest rates, with the hopes for the December Federal Open Market Committee (FOMC) potentially being particularly overblown.

At press time on Wednesday, December 4, there is a 73.8% chance of a 25-50 basis points (BPS) reduction to the range between 425 and 450 BPS, per CME Group’s FedWatch tool. Simultaneously, there is an estimated 0% chance of a drop to between 400 and 425 BPS and 26.2% odds of the funds rate remaining level.

Why Jim Cramer is fearful of the coming FOMC interest rate decisions

Additionally, Cramer believes there is a great danger of complacency given the success of the U.S. stock market in recent months and believes that any regulatory surprises could cause significant turbulence.

The former hedge fund manager also cited the Fed’s wording after its previous decision – America’s central bank concluded that the economic situation remains ‘uncertain’ – and added that several additional key metrics need to emerge before the picture becomes clearer.

It is worth pointing out that the main of these pending metrics – the jobs report on Friday, December 4, and the Consumer Price Index (CPI), due next week – themselves have the power to crash the market.

Indeed, employment figures and the report on industrial production in the U.S. proved enough to trigger massive stock and cryptocurrency market sell-offs during the summer. However, admittedly, the downturns were as brief as they were sharp.

Additionally, the Fed’s previous interest rate cuts – the 50 BPS cut in September and the 25 BPS reduction in November – have also been criticized.

Why interest rate cuts might stall in the coming months

Specifically, many analysts were forecasting that the decade-high interest that emerged from the decade-high inflation that permeated the post-Covid economy would cause enough pressure to trigger a recession in late 2023 or sometime in 2024.

As it turned out, the exact opposite happened, and U.S. stock soared, with the benchmark S&P 500 index soaring 27.56% to record highs near 6,049.88 points.

The growth – particularly if the CPI comes in hotter than expected and the jobs report is satisfactory – could prove a strong argument against implementing further cuts in December and across several subsequent FOMC meetings.

Such an argument is bolstered by several market experts who have, even before the September and November decisions, been criticizing the U.S. Central Bank for not tightening conditions further.

Gordon Johnson of GJL Research – generally best known as one of the biggest and most prominent Tesla (NASDAQ: TSLA) bears – was among the harshest of critics and went as far as to forecast the ‘most predictable forthcoming inflation crisis ever’ in the coming years, while laying the blame squarely on Chair Jerome Powell and Treasury Secretary Janet Yellen as far back as February.

Featured image via Shutterstock