Newton Gitonga

Amidst the prevailing broader bearishness, L1 project Kadena has confirmed plans to suspend all business operations with immediate effect.

The firm attributed the move to unfavorable market conditions, which have forced it to terminate years-long attempt to shape PoW (proof-of-work) scalability.

The Kadena team took to X to express regret and gratitude. The official announcement read:

We regret that, because of market conditions, we are unable to continue to promote and support the adoption of this unique decentralized offering.

Kadena has announced that it regrets to inform the public the organization can no longer sustain business operations and will immediately halt all activities along with active maintenance of the @Kadena blockchain.

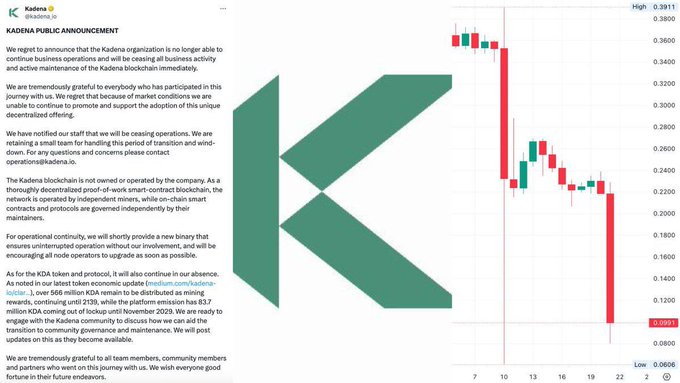

Native token KDA felt the heat almost instantly as panic spread across cryptocurrency exchanges.

The digital coin crashed from a daily peak of $0.2209 to $0.088, a roughly 60% plunge in hours.

Blockchain to remain operational

While the firm behind the Kadena project is winding down, the blockchain isn’t vanishing overnight.

The team emphasized creating a truly decentralized network maintained by community developers and independent miners. Kadena will now publish a final software upgrade to enable the platform to run without the team’s direct involvement.

Meanwhile, a small internal staff will remain in place for a while to facilitate the transition and manage communications.

They clarified that smart contract maintainers and miners have been crucial in the system’s operations.

The statement read:

The Kadena blockchain is not owned or operated by the company. As a thoroughly decentralized proof-of-work smart-contract blockchain, the network is operated by independent miners, while on-chain smart contracts and protocols are governed independently by their maintainers.

KDA is still in the game

While uncertainty grips the community, Kadena’s token model allows the network to continue running long after the firm’s exit.

There are more than 566 million KDA assets for mining rewards, and distributing them may take until the year 2139.

Furthermore, the project will release 83.7 million coins periodically until November 2029.

That confirms a robust economic structure for users and miners to keep Kadena’s ecosystem functional if the community considers it worth continuing.

The team has urged the community to participate in shaping maintenance and governance.

Kadena might herald a new era where collective efforts (not corporate oversight) run cryptocurrency projects.

KDA price outlook

The native token exhibited substantial bearishness on the daily chart after a sharp dip.

KDA is trading at $0.08809 after shedding more than 60% of its value over the past 24 hours.

Its trading volumes have soared by over 1,200% to indicate amplified trader activity, potentially from market players exiting amidst prevailing doubt.

KDA will likely plunge further before securing a reliable footing, especially with the current broader market indecision.

Meanwhile, Kadena’s shutdown reflects the harsh financial reality that blockchain startups encounter today.

Many have failed to navigate the relentless pressure of bearish markets and dwindling investor interest after early enthusiasm despite their innovative projects.

Enthusiasts will watch KDA’s performance in the coming years as the corporate team hands over the project to the community.

The post KDA crashes 60% as Kadena ceases operations amid harsh market conditions appeared first on Invezz