Newton Gitonga

Cryptocurrencies traded in the green today as bulls flexed after Monday’s crash.

Amidst the optimism, Chainlink (LINK) stole the show as it touched price levels not seen since November 2021.

LINK’s outperformance follows massive institutional purchases.

Blockchain data shows Donald Trump’s World Liberty Financial (WLFI) splashed millions to purchase Chainlink, Ethereum, and AAVE.

LINK price hits 37-month peaks

Chainlink led crypto gainers with robust uptrends within the past 24 hours.

Santiment revealed that the alt topped $29, a level it has never hit in 37 months.

🔗📈 Chainlink has surpassed $29 for the first time in 37 months, generating excitement from the community. This latest decoupling of LINK’s price has been supported by rising levels of whale & shark accumulation.

🐳🦈 Wallets with 100K+ LINK have added 5.69M LINK to their…

The highlight stirred the crypto market, with many predicting a materializing altcoin season.

LINK’s recent performance comes after significant accumulation from crypto whales and sharks (investors holding more than 100,000 LINK tokens).

These entities have purchased around 5.69 million coins within the past two months.

Contrarily, traders with less than 100,000 LINK entered a selling spree, dumping 5.67 million tokens.

Historical trends suggest that assets witness surged market value when large players accumulate while smaller holders panic-sell.

The latest move by World Liberty Finance to acquire Chainlink and other top altcoins testifies to such trends.

Trump’s World Liberty Finance buys ETH, LINK, and AAVE

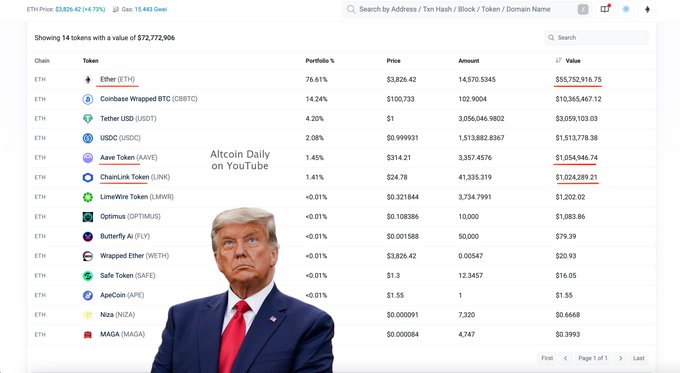

Etherscan stats reveal that Trump-affiliated DeFi protocol World Liberty Finance has spent millions in USDC Coins to acquire top altcoins.

The firm used 1 million USDC to purchase 41,335 LINK tokens at $24.2 average price.

Also, the wallet acquired 3,357 AAVE at a $297.8 average price in more than ten transactions.

Lastly, the WLFI wallet acquired Ethereum worth $10 million (2,631 ETH) at a $3,801 average cost.

The DeFi protocol now holds ETH worth $57.2 million (14,574).

World Liberty Finance’s altcoin address held assets worth approximately $18 million at press time.

The balance includes stablecoin USDC and USDC, Coinbase Wrapped Bitcoin, and some meme tokens.

LINK price outlook

The coin traded at $28 during this writing, up 20% on its daily chart.

The 60% surge in daily trading volume underscores impressive trader sentiments behind LINK’s price action.

A renowned analyst, WSB Trader Rocko, highlighted that LINK can hit $100 in the ongoing bull rally.

That would translate to a 257% price surge from current price levels.

🚨BREAKING: Coinbase To Integrate #Chainlink Standard To Scale Institutional Adoption of Digital Assets, Send $LINK to $100 🚀💎🙏

“Chainlink CCIP is essential infrastructure that enables asset issuers, banks, and financial institutions to create tokenized asset solutions that…

Rocko underscored Chainlink’s strategic collaborations with leading companies such as Coinbase, Invesco, Swift, and Circle as key drivers of long-term success.

Chainlink’s CCIP, an interoperability protocol for developers to create secure dApps for cross-chain transactions, proves crucial in the Real World Asset tokenization sector.

The technology has gained popularity in the evolving financial sector. Recently, 21X partnered with Chainlink to tokenize Europe’s securities.

The increased institutional interest remains crucial in driving LINK prices to record highs in the upcoming weeks and months.

The post LINK price tops 2021 levels as Trump’s World Liberty Finance goes altcoin shopping spree appeared first on Invezz