Newton Gitonga

Cryptocurrencies traded in the green on Wednesday as Bitcoin steadied above $105K, trading at $107K. While altcoins remain on the edge, the $MELANIA meme coin lost nearly 5% on its daily chart amidst fresh concerns.

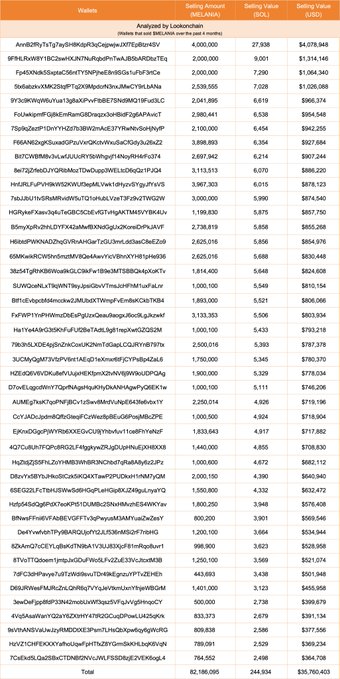

On-chain data shows Melania’s team offloaded 82.18 million, worth approximately $35.76 million, $MELANIA coins in the past four months.

That represents 8.22% of the meme token’s total supply.

Notably, these transactions happened across 44 wallets.

The #Melania meme team sold 82.18M $MELANIA(8.22% of total supply) over the past 4 months across 44 wallets, cashing out 244,934 $SOL($35.76M).

Most of the $MELANIA tokens were sold through adding and removing liquidity.

solscan.io/token/FUAfBo2j…

What’s more suspicious these sales didn’t occur on the open market but were through liquidity manipulation – adding and removing liquidity to quietly extract value without immediately affecting $MELANIA’s price actions.

Melania team rugs $35M through 44 wallets

While DeFi often promises anonymity, repeated transactions grabbed attention, sparking insider trading allegations.

Notably, 44 wallets moved assets in similar patterns.

Analysts believe coordinated actors or an insider controlled the wallets and gradually exited while retailers joined.

The transaction drained 244,934 SOL tokens, worth around $35.76 million at the current market price.

Meanwhile, the repeated action of adding and removing liquidity, especially during $MELANIA price surges, magnified insider trading speculations.

These activities have drained investor trust.

The worst of all, the team hasn’t communicated, adding to the prevailing fears.

These incidents highlight the dangers of trust in the anonymous blockchain world.

Warning and lessons

Experts and market players have cautioned against politician-backed cryptocurrencies.

Ethereum’s founder alleges that officials use these ventures to grab money from innocent followers.

Melania’s unfolding scandal is part of dominant actions across most meme assets, where anonymous teams hold significant token supply and exit quietly through liquidity manipulation.

While the insider trading claims might not reach the courtroom, the damage is already happening in the public.

Industry leaders and critics call for more regulation and transparency, and Melania is emerging as a textbook example of when greed dominates.

Senator Adam Schiff has introduced a bill to ban presidents and top executives from benefiting from crypto.

$MELANIA crypto price

The meme token experienced surged volatility with a swift dip after the asset sell-off revelations.

Bearish sentiments dominated as investors and enthusiasts took it to social media, urging DeFi platforms and CEXs to flag doubtful wallet activities and pause trading to reduce damages.

$MELANIA trades at $0.2083, down by nearly 5% in the past 24 hours.

Its daily trading volume has plummeted by over 35%, signaling widespread bearishness.

The meme crypto will likely dip further as selling pressure mounts.

Meanwhile, the broader PolitiFi crypto space displayed mixed performances as tokens retreated after recent bounce-backs.

The PolitiFi market cap plunged 2% in the previous 24 hours to $2.12 billion at press time (Coingecko data).

The post $MELANIA coin team hit with insider trading allegations after $35M token dump appeared first on Invezz