Lele Jima

Michael Saylor, the founder and chairman of software company MicroStrategy, characterizes Bitcoin (BTC) as the best strategy following the company’s latest 169 BTC purchase.

The MicroStrategy exec made the assertion in a tweet yesterday while reflecting on the tremendous surge in the company’s stock price since its initial adoption of Bitcoin.

MicroStrategy Stock Outperforms Bitcoin and Other Tech Giants

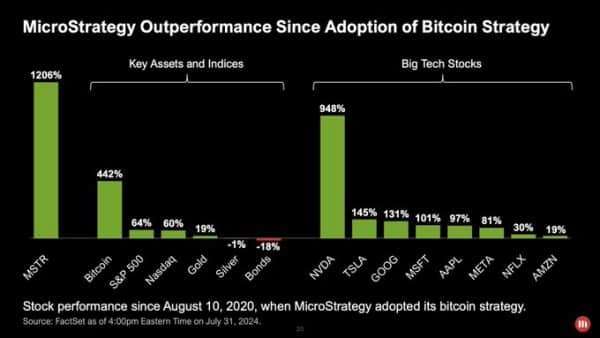

Since the company pivoted to Bitcoin on August 10, 2020, MicroStrategy’s stock price has increased by a whopping 1,206%, outperforming the shares of other tech giants like NVIDIA (NVDA).

According to the data, NVDA has witnessed a surge of 948%, while Tesla (TSLA), Google (GOOG), and Microsoft (MSFT) shares have skyrocketed 145%, 131%, and 101% in the same timeframe, respectively.

Interestingly, MicroStrategy’s stock has also outperformed Bitcoin’s gain since August 10, 2022. Per the data, Bitcoin’s price has only increased by 442% within this period. Similarly, S&P 500, Nasdaq, and Gold recorded modest growth of 64%, 60%, and 19%, respectively.

MicroStrategy Suffers Net Loss in Q2 2024

Meanwhile, MicroStrategy also highlighted the outstanding performance of its shares in its report for the second quarter of 2024. The report indicated that MicroStrategy incurred a net loss of $102.6 million due to a $180.1 million impairment charge on its Bitcoin holdings.

This figure is significantly higher than the $24.1 million impairment charge recorded in the second quarter of last year.

Bitcoin Holdings

It bears mentioning that MicroStrategy purchased 169 BTC worth $11.4 million in July. As of July 31, 2024, MicroStrategy holds a total of 226,500 BTC. The company acquired all these tokens at an average price of $36,821 per token, bringing the total acquisition value to approximately $8.34 billion.

At the current exchange rate of $65,054, MicroStrategy’s 226,500 BTC are worth $14.73 billion, reflecting a 76.61% increase from their original purchase price.

Despite its hefty Bitcoin holdings, the software company still plans to raise $2 billion to acquire more BTC. Yesterday, MicroStrategy applied with the U.S. SEC to sell its Class A common stock to raise $2 billion. The funds raised will be used for additional BTC purchases and other general corporate purposes.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-