Newton Gitonga

Digital assets hovered in the green on Thursday as Bitcoin finally hit the $100,000 milestone, currently trading at $102,835.

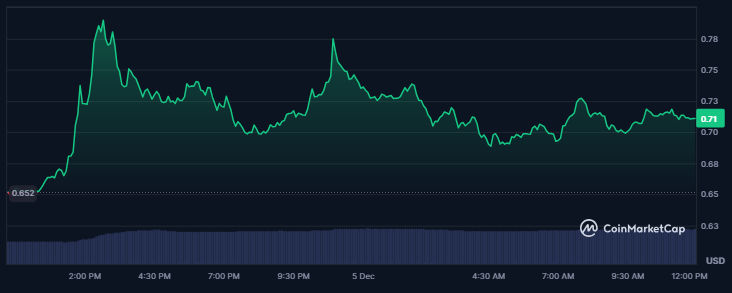

Terra Luna joined the upside journey, soaring 21.13% on its daily chart as it climbed from $0.6520 to $0.7898.

Notably, the solid jump saw the altcoin breaking free from a descending channel, signaling a significant buyer comeback.

LUNA trades at $0.7200, and bulls target the vital resistance at $0.895.

Breaching this obstacle could catalyze smooth upswings to $1.50. That would translate to a 108.33% surge from the current values.

Furthermore, Terra’s price actions appeared to form a golden cross, confirming possible trend reversals.

LUNA price ready for a 100% jump

The latest breakout from a descending channel formation indicated a significant change in market sentiments.

LUNA bulls target the crucial resistance barrier at $0.895.

The level remains vital in determining whether Terra will sustain the latest breakout.

Stability above $0.895 might catalyze a massive upswing to $1.50.

That would mean a 108.33% surge from LUNA’s current price.

LUNA price prediction: what technicals say

Indicators support the asset’s bullish outlook. The emerging golden cross cements the chances of bullish reversals.

This technical signal often confirms the beginning of a solid uptrend.

Also, the Moving Average Convergence Divergence suggests a robust uptrend, with the MACD line well beyond the signal line.

Moreover, the Relative Strength Index at 78 suggests overbought market conditions.

That signals potential retracements for LUNA before uptrend resumption.

Meanwhile, the social dominance hit 0.165 from 0.100 within a day.

The hiked social attention can attract significant market interest to support stable rallies.

Nonetheless, magnified social dominance often triggers massive volatility, with sentiments prone to rapid shifts in either direction.

Further, Terra’s long-to-short ratio is 50.61% to 49.39% (Coinglass data), highlighting a near balance between buyers and sellers.

The equilibrium reflects uncertainty in LUNA’s future performance.

Nonetheless, a successful move past the $0.895 resistance would see buyers dominating.

Also, the prevailing market sentiment suggests that price dips could be short-lived.

LUNA price action

The altcoin painted its daily chart green, up 10% from the opening price to hover at $0.7200 at press time.

Its 24-hour trading volume has increased by 55% to $368.35 million, magnifying trader optimism.

Social metrics, technical indicators, and LUNA’s latest price moves suggest trend reversals.

Nevertheless, the $0.895 resistance remains crucial for the token’s upcoming trajectory.

Breaching this hurdle and a golden cross completion would catalyze impressive upswings to $1.50.

However, caution remains paramount, as RSI’s overbought conditions and the evenness between sellers and buyers highlight possible volatility.

Meanwhile, analysts remain confident about an altcoin season after Bitcoin’s surge past $100,000.

Michael van de Poppe highlighted Bitcoin’s potential consolidation around current values and what it could mean for alts.

LUNA’s reaction to the $0.895 hurdle will define its price trajectory in the upcoming sessions.

With bullish developments, such as Binance increasing LUNA trading leverage to 75x, the upside appears to have fewer obstacles.

The post Terra (LUNA) price could surge 100% as bulls break out of a descending channel pattern appeared first on Invezz