Newton Gitonga

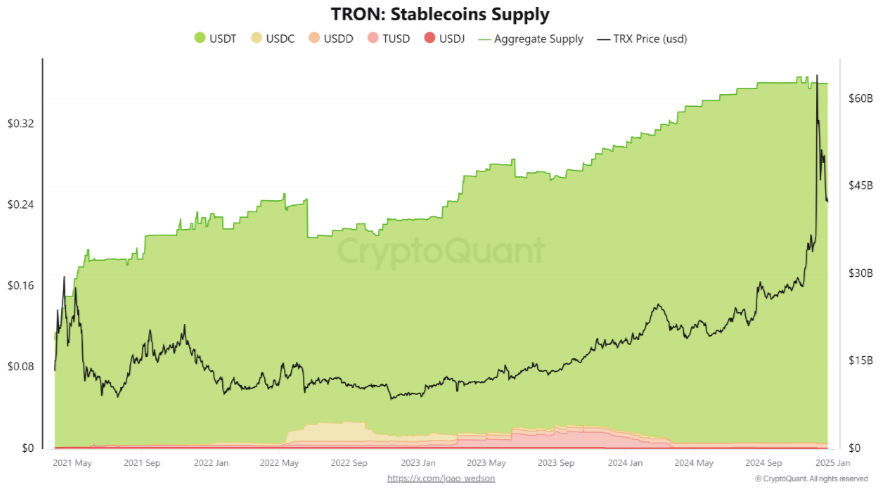

CryptoQuant data revealed that stablecoin supply on the Tron blockchain stabilized at $62 billion after consistent surges over the past few months.

That signals paused minting of new assets, confirming balanced markets – where stablecoin demand meets the prevailing supply.

Excluding Tether’s USDT, stable increases in the likes of USDC, TUSD, USDJ, and USDD confirmed the maturity and diversity of Tron’s ecosystem.

That highlights stable market conditions, where substantial disruptions are less likely and potentially bolster investor confidence.

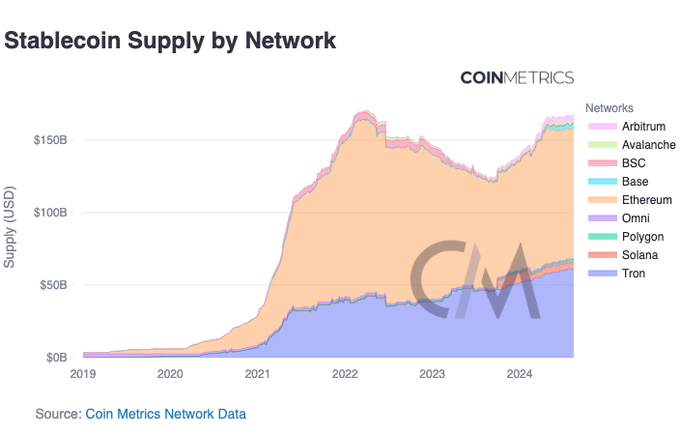

Further details show Tron’s impressive growth in the stablecoin sector in recent months, challenging Ethereum’s dominance.

Still blows my mind that Tron has such a large share of the stablecoin market

>1/3 of stablecoin supply (mostly USDT) is on Tron, second to Ethereum

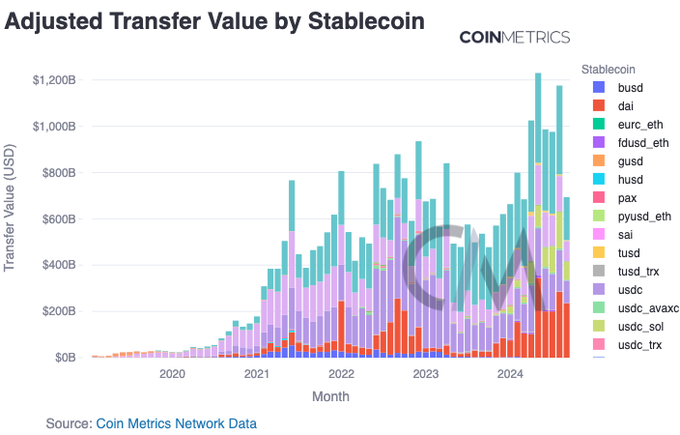

USDT on Tron had $384B of adj. transfer value in July – highest of any stable on any chain

h/t @coinmetrics new stablecoin…

While ETH maintained notable activity in USDT transactions, Tron accounted for 64% of this market, a significant upswing from 57% in November.

The increased market share underscores Tron’s increasing traction within the stablecoin industry.

The blockchain likely attracts participants due to its quicker processing times and cost-friendly transaction charges.

Meanwhile, the maturing Tron ecosystem positions the native token TRX for remarkable growth in the coming months and years.

TRX price outlook

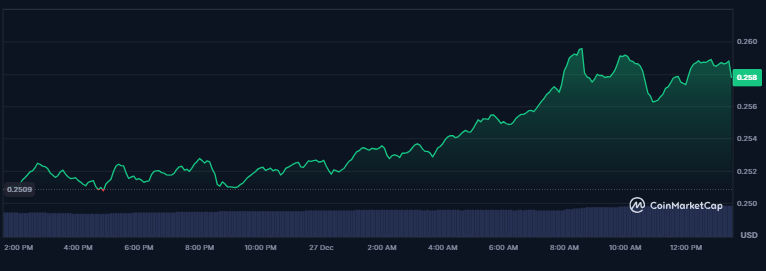

TRX traded at $0.2587 after gaining nearly 4% on its daily chart, with a 25% increase in daily trading volume (to $1.04 billion) showing impressive investor interest.

Meanwhile, the recovery rally saw TRX surpassing the 200 Exponential Moving Average line at $0.25.

Extended bullish actions would trigger surges toward the 52-week peak at $0.45.

That would translate to a 74% gain from TRX’s current prices.

Further, trend-based FIB levels reveal $0.54 as a potential target in January.

Such uptrends amidst broad market optimism would likely open the path to the $1 psychological level.

However, impressive buyer activity is essential for such rallies.

Bearish reversals would catalyze price declines toward the significant support barrier at $0.2251.

Analyst bullish on TRX: targets $1.11 this cycle

Amidst the bullish ecosystem developments, attention has shifted to TRX’s price actions and what to expect.

$TRX (TRON) is still holding up nearly +300% since the displayed logarithmic ‘wedge’ breakout and measured movements continue to suggest higher!

With this breakout holding, another +444% move from here to $1.11 can still be on the radar and prices look to be well en-route to.

TRX’s latest movements saw it forming a bullish pattern, which signals robust gains, according to analyst JAVON MARKS.

He highlighted that Tron has surged by around 300% since its logarithmic wedge breakout.

Meanwhile, the measured movement suggests more gains for TRX.

MARKS stated that maintaining the recent breakout could propel the altcoin by another 444% to $1.11.

Tron’s maturing ecosystem will likely attract more investors and traders, boosting growth and TRX’s price movements in the upcoming sessions.

The prevailing trajectory suggests that TRX would close 2024 on a bullish note before exploding early in 2025.

Analysts forecast significant breakouts for cryptocurrencies in the coming few weeks, citing optimistic developments such as Donald Trump’s inauguration.

The post TRX price prediction: analyst forecasts 444% surge as Tron’s stablecoin supply reflects a matured ecosystem appeared first on Invezz