Newton Gitonga

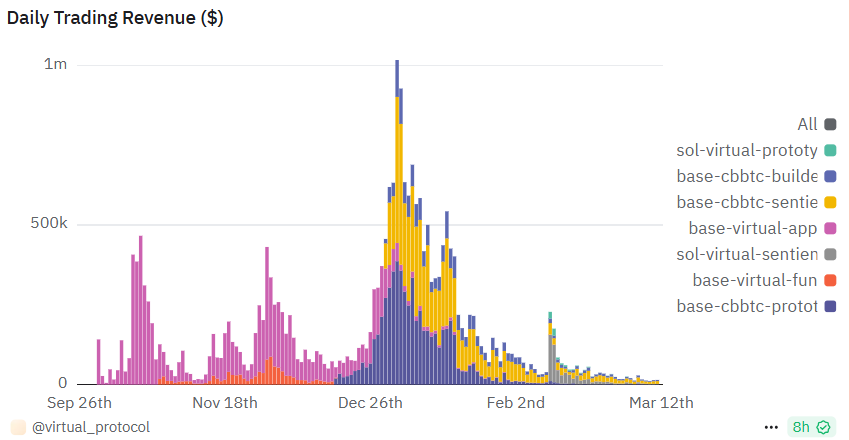

The decentralized AI platform Virtual Protocol has seen a notable decline in daily trading revenue.

According to Dune Analytics data, the metric has slumped from $1,016,229 on 2 January to yesterday’s 14,850 – a 98.54% dip.

Virtual Protocol facilitates artificial intelligence blockchain agents and benefited from the AI craze early in the year.

However, the platform sees dwindled traction as optimism surrounding AI and cryptocurrency integrations fades.

Furthermore, the number of AI agents created on the platform slumped substantially from 1,365 on November 2024 to 3 on 11 March.

That reflects a significant decline in artificial intelligence within the digital assets sector.

Speculative trading fueled Virtual Protocol’s initial growth.

The platform attracted multiple investors and traders during the AI crypto cycle.

However, these players exited as the hype faded, deteriorating the project’s activity and demand.

Also, the broad market downturn added to the woes.

Digital currencies have disappointed in 2025 due to macro conditions, including the ongoing Trump trade war.

Moreover, impacted nations are threatening counter-tariffs, suggesting prolonged struggles in the financial sector.

Europe is set to impose counter-tariffs on $28.33 billion of U.S. goods in April, responding to Trump’s 25% tariffs on steel and aluminum imports. This move signals escalating trade tensions that could impact various sectors, including manufacturing and agriculture.

VIRTUAL price prediction

The altcoin has underperformed amidst the negative sentiments, losing over 50% of its value in the past month.

VIRTUAL trades at $0.5703, down 35% within the last 24 hours and week, respectively.

Further, it has lost approximately 90% since $5.1, its January record highs.

However, it gained more than 3% in the past 24 hours as Bitcoin displayed resilience amidst Donald Trump’s tariffs.

Meanwhile, VIRTUAL’s underperformance reflects broad crypto struggles in recent sessions. AI agents were among the most hit.

Coingecko data shows the market capitalization of AI agents crashed from $16.6 billion in January to $4 billion at press time.

Furthermore, the trading volume has slumped from nearly $3 billion to $800 million.

That indicates a significant decline in trader interest and appetite within the last three months.

Such trends signal continued struggles for VIRTUAL.

The alt could slump further unless the AI agent narrative resurrects amidst broad-based crypto rallies.

A relief rally would see the alt’s bulls targeting liquidity zones at $0.6 and $0.8, an approximately 40% surge from its current price.

What’s next for AI and crypto integrations?

Virtual Protocol’s plunge signals faded interest in AI-centered blockchain applications.

However, broad market weakness contributed to the significant decline.

Crypto AI agents are at the center of the technology and financial revolution.

The innovation looks to automate tasks like security monitoring, trading, governance, and portfolio management.

The segment has flourished during broad-based rallies with significant rallies.

Enthusiasts will watch whether cryptocurrency AI projects will lead the next bull run.

Fluence Project’s co-founder Evgeny Ponomarev stated:

“AI agents will use crypto 100% for payments, creating transparent and seamless payment trails.

“We’re entering a world of millions, if not billions, of AI agents—conducting business, performing tasks, and driving activity. But here’s the key:

Crypto is built for AI agents. Fiat? It wasn’t designed for them—it simply doesn’t work. AI agents will use crypto 100% for…

Meanwhile, prevailing sentiments suggest continued near-term struggles for Virtual Protocol.

The post Virtual Protocol (VIRTUAL) revenue plunges 99% as AI agent demand declines appeared first on Invezz