Mark Brennan

Chainlink whales have increased their holdings by 6.2M LINK ($76.88M) amid market volatility, suggesting confidence in LINK’s future performance.

Chainlink whales have significantly increased their holdings, accumulating over 6.2 million LINK, worth approximately $76.88 million, in the past week. This activity, recently reported by Ali Martinez, highlights the notable behavior of large holders amidst fluctuating market conditions.

#Chainlink whales have snapped up over 6.2 million $LINK this past week, totaling approximately $76.88 million! pic.twitter.com/Hats1Nmsny

— Ali (@ali_charts) July 8, 2024

According to Ali’s chart, the price of LINK has shown volatility, with sharp drops, fluctuations, a significant rise in mid-May, and subsequent declines. Despite this, the whale holdings have shown a clear upward trend, especially in the last week. This suggests that whales are taking advantage of lower prices to increase their holdings.

Interestingly, the accumulation of LINK by whales has occurred despite the downward trend in price. This inverse relationship might indicate that whales are confident in LINK’s future performance, using the lower prices as an opportunity to strengthen their positions.

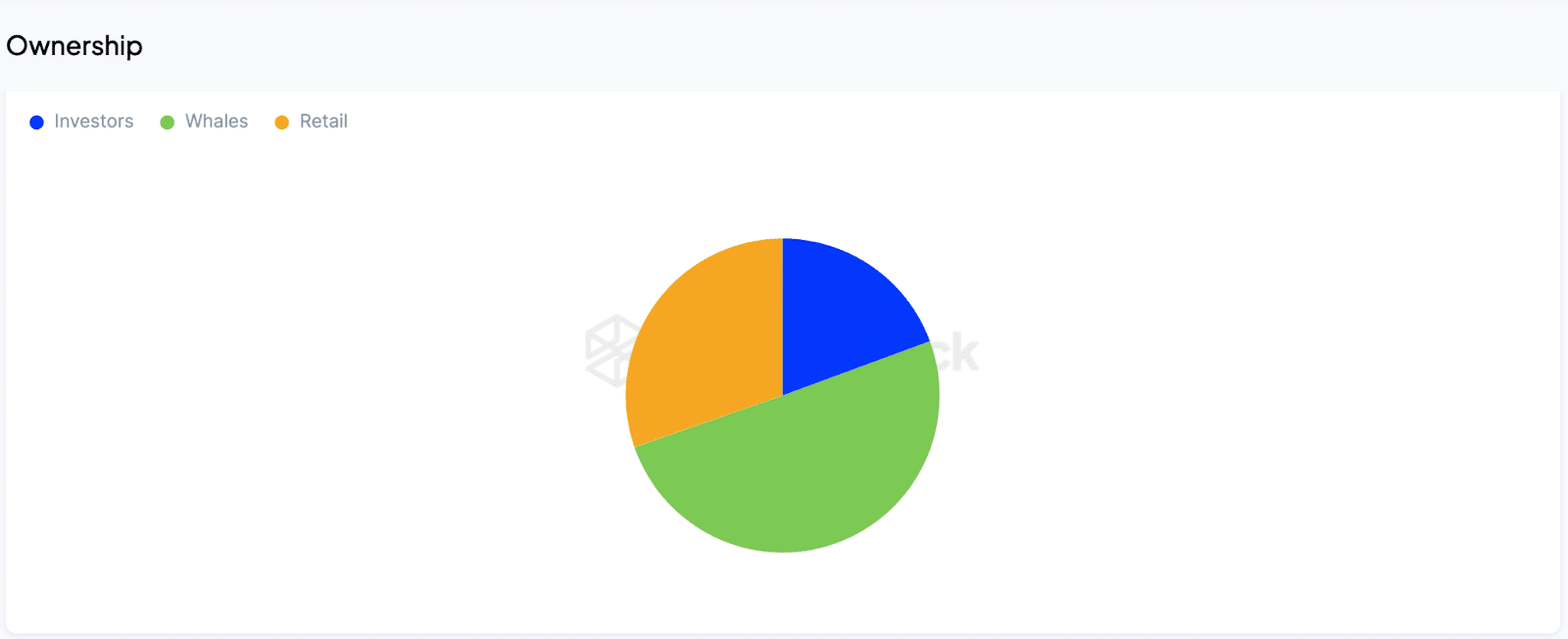

Ownership Distribution and Market Sentiment

The ownership distribution of LINK reveals that whales hold approximately 50.29% of the total supply, equivalent to about 502.89 million LINK. Notably, this high concentration among a small number of addresses can lead to higher market volatility, as their actions can significantly impact the price.

The chart illustrates the distribution among different holders: whales, investors, and retail. Although exact percentages for investors and retail are not provided, the significant portion held by whales indicates their dominant influence on the market dynamics.

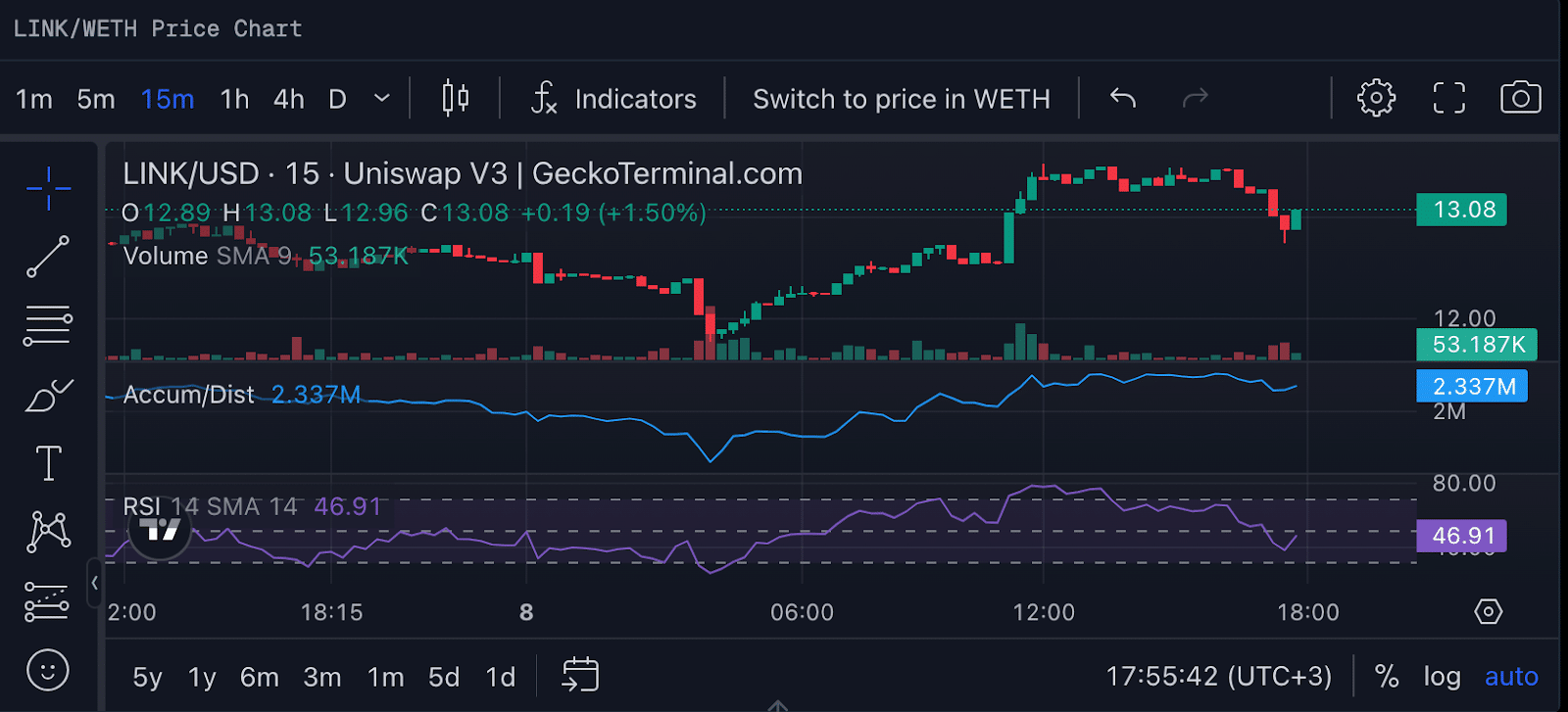

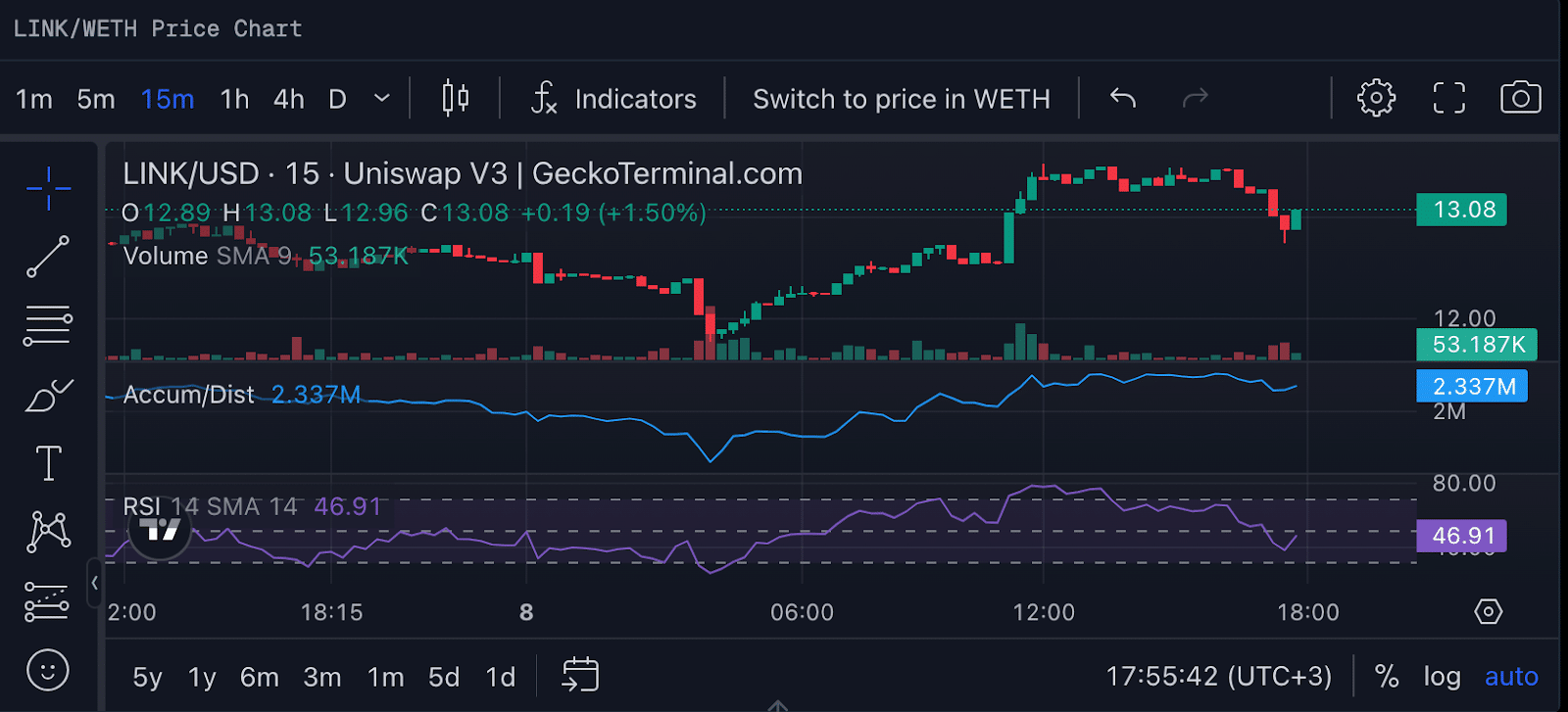

Shorter Term Volume and Accumulation Trends

LINK’s Volume over a 15-minute timeframe stands at 53.187K, reflecting the average short-term volume. Increased trading volume often accompanies significant price movements. The Accumulation/Distribution indicator, at 2.337M, suggests balanced buying and selling activities, as the metric maintains stability.

The Relative Strength Index (RSI) at 46.91 indicates a neutral market, with no significant momentum in either direction.

It is crucial to remember in June; Chainlink whales took advantage of a brief market recovery to offload some of their holdings. The Santiment chart shows that as of June 16, the top 100 whale wallets held 704.47 million LINK tokens.

However, following Ethereum’s landmark legal clearance from the SEC on June 17, these whales sold off about 2.25 million LINK tokens by June 20, worth approximately $40 million.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-