Newton Gitonga

Chainlink (LINK) has remained on the investors’ radar over the past week following impressive price actions.

The decentralized Oracle token soared 21.78% from $19.74 on January 1 to today’s $24.04.

LINK displays solid momentum as it rebounded from a crucial support barrier around the $19 mark, suggesting potential extended gains.

Moreover, whale accumulation adds credence to Chainlink’s recovery.

Whales fuel LINK’s recovery

Chainlink closed December on a bearish note as it plunged from mid-month highs of above $30.

However, the altcoin saw dip-buying activities from large-scale holders after the failed Santa rally.

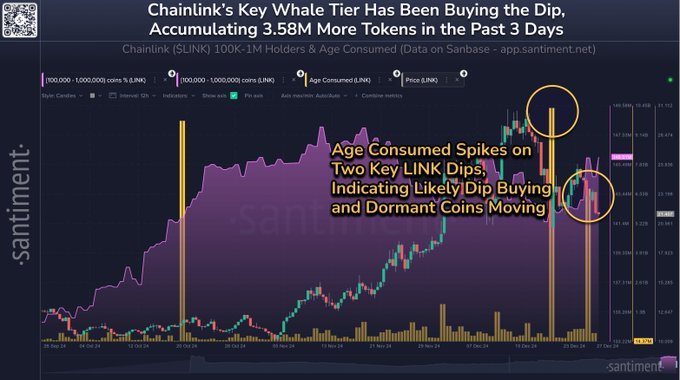

Santiment revealed a significant whale accumulation on December 28.

🔗🐳Chainlink has retraced in the second half of December, like the vast majority of crypto has. Interestingly, though, their key active whales that hold between 1M-10M LINK have accumulated 3.58M coins (worth $76.9M) in just the past 3 days. 👀

The data showed that investors holding 1 million to 10 million of the token purchased another 3.58 million LINK coins (worth approximately $76.9 million).

Further details show whales with 100,000 – 1 million tokens also scooped the latest dip.

These trends reveal a crucial strategy where investors leverage price crashes to accumulate at discounted prices.

That confirms confidence in solid recoveries after bearish moves.

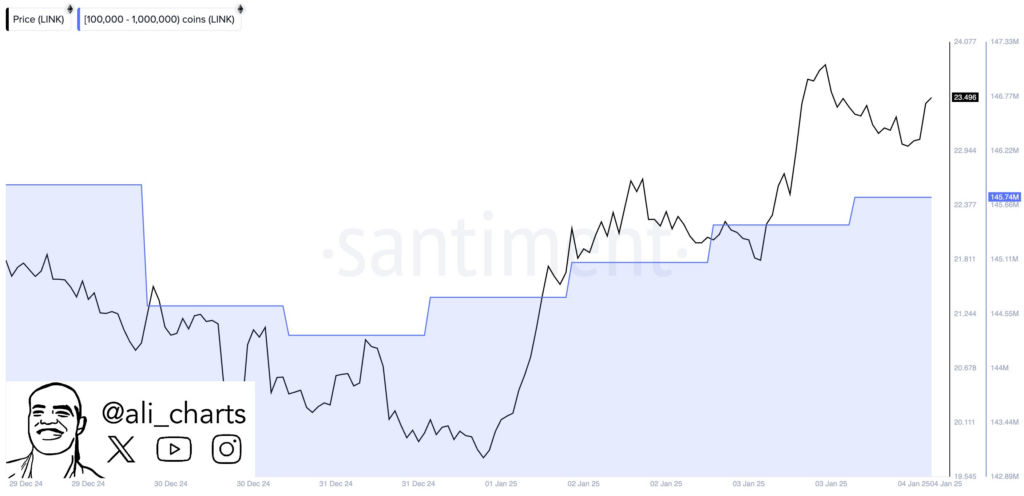

Moreover, popular analyst Ali Martinez highlighted that whales continued to purchase Chainlink early in 2025.

The dip-pocketed players added more than 1.40 million tokens to their bags in January week 1

The continued accumulations hint at investor trust in LINK’s long-term performance.

Chainlink’s price performance

The altcoin has maintained bullish trends in the first week of 2025 and looks ready for more gains.

LINK trades at $23.90 at press time, with a $600 daily trading volume highlighting significant bullishness.

The latest gains propelled Chainlink past $22.54 – a zone that previously restricted further upswings.

Moreover, the alt experiences notable buying activity around the flipped resistance, suggesting renewed buyer interest.

The Relative Strength Index of 57.27 suggests balanced sentiments with a bullish edge.

Bulls will likely target the next crucial resistance zone around the $24.50 mark.

Overcoming this hurdle will likely support more gains towards $26.90 and last month’s high above $30.

Nonetheless, losing the $22.54 support zone could catalyze retracements toward $19.16 before sentiments define Chainlink’s trajectory.

Broder crypto market: BTC nears $100k

Meanwhile, broad market sentiments remain vital in determining the altcoin’s movements.

The digital assets space exhibits optimism as Bitcoin approaches the $100K psychological level.

The Fear and Greed Index has also jumped from last week’s 50 (neutral) to 60 (greed) at press time.

That indicates renewed confidence as investors brace for historic times – with the United States’ most pro-crypto congress.

🇺🇸RIPPLE CEO: “MOST PRO-CRYPTO CONGRESS EVER”

Brad Garlinghouse is betting big on the 119th Congress, calling it a turning point for U.S. crypto policy.

With FIT21, stablecoin regs, and SEC shake-ups on deck, the XRP fam is hoping for a “W.”

Garlinghouse shades the…

Experts forecast friendly crypto regulations from the new government, which promised to support crypto innovations in the US.

The United States SEC has hindered crypto growth under the outgoing chair, Gary Gensler.

However, the newly-appointed Paul Atkins signal a new wave for the market.

In conclusion, Chainlink’s ongoing recovery displays robust momentum amidst whale interest.

Large-scale investors have accumulated the latest dip, hinting at remarkable rebounds for the alt.

The prevailing broad market sentiments support LINK’s bullish trajectory.

Meanwhile, enthusiasts should monitor the near-term support at $22.54.

The post Whales drive Chainlink’s recovery from vital support: what’s next for LINK price appeared first on Invezz