Paul L.

The 2024 gold price rally, which has coincided with the growth of the S&P 500 index, could be signaling a concerning trend as markets witness a shift in investor interests.

Since early 2022, gold has gained nearly 50%, compared to a 40% rise in the S&P 500 Total Return Index and a 20% drop in crude oil.

These trends suggest that the market may be increasingly wary of overvalued stocks and global instability, especially given that gold has risen during heightened geopolitical tensions, Bloomberg Intelligence commodity strategist Mike McGlone noted in an X post on November 9.

According to McGlone, the elevated ratio of U.S. stocks to GDP is a key factor contributing to gold’s resilience, even as the stock market has soared in an artificial intelligence-driven bull run.

Historically, high stock-to-GDP levels have aligned with periods where gold outperformed stocks.

“The Rock Beating Stocks Might Not Be a Good Sign – Gold’s on-par performance with the S&P 500 the past three years may suggest it’s gaining an upper hand vs. the AI-driven stock market,” McGlone said.

The expert observed a notable shift in geopolitical space in February 2022, when China and Russia declared an “unlimited friendship,” Since then, global risks have intensified, building on the metal’s traditional role as a hedge against periods of uncertainty.

At the same time, the recent gold record highs have partly been influenced by growing geopolitical tensions in the Middle East, which pit Iran and Israel.

What next for gold

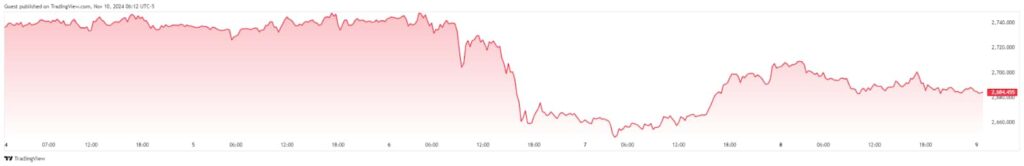

Gold has reached new highs, targeting the $3,000 resistance level, which some analysts project could be achieved by 2025. However, following Donald Trump’s re-election, the yellow metal has retraced, testing the $2,600 support zone.

In an earlier post, McGlone noted that gold’s bullish performance, which has coincided with a booming stock market and 4% Treasury yield gains, suggests a shift in investor priorities, as investors are leaning towards safe-haven assets.

He pointed out tha Trump’s second term, which could boost equities, may also support gold demand as a hedge against potential volatility.

The S&P 500 has also been on an upward trajectory recently, surpassing the 6,000 mark for the first time. This growth was partly inspired by market optimism surrounding Trump’s re-election.

“Consensus that US equities will go up under a second term for President-elect Donald Trump might be a top factor buttressing gold,” he added.

Notably, analysts view Trump’s policies, such as corporate tax cuts, as bullish for the general economy and the stock market.

Although the index has surged to new highs, the technical setup raises concerns about a potential collapse, pointing to one of the worst crashes in history.

In summary, as gold and stocks exhibit bullish momentum, there remains a level of uncertainty, meaning investors should potentially diversify between the two asset classes to mitigate any future risks.

Featured image via Shutterstock