Paul L.

Gold has experienced a historic price growth streak in 2024, with notable quarterly gains that analysts project will continue into the coming year.

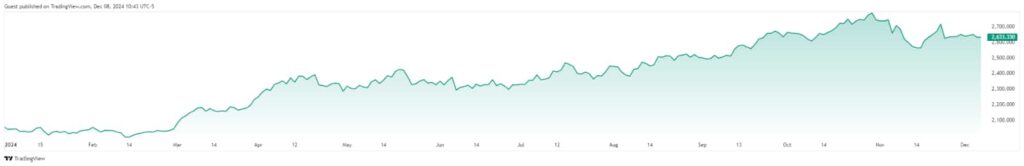

As a recap, gold is closing the year on a high note, having recorded five consecutive quarters of growth. In Q3 2024 alone, the precious metal soared by $307, marking one of the most significant quarterly gains in recent history, as noted by precious metals forecasting platform Gold Predictors in an X post on December 8.

According to the platform, ongoing geopolitical tensions stemming from the Middle East crisis, which began in 2023, have played a pivotal role in bolstering gold’s safe-haven appeal.

To this end, Gold Predictors stated that the metal has further upside potential, suggesting no existing signals are hindering its upward trajectory for 2025.

“These developments suggest no signs of a slowdown for gold in 2025, as the crises continue to remain at elevated levels. Buy the dips in gold,” the platform noted.

Gold’s path to $3,000

Overall, gold’s rally in 2024 was widely anticipated to culminate in a high of $3,000. Still, price momentum slowed after the United States election, whose outcome, with Donald Trump’s victory, is considered bullish for the economy.

Although the rally faltered, other market players remain optimistic about continuing the recent uptrend. For instance, as reported by Finbold, Bloomberg Intelligence Commodity Strategist Mike McGlone suggested that geopolitical tensions could drive gold to $3,000 in 2025.

Similarly, banking giants such as Goldman Sachs (NYSE: GS) predict that the metal could reach $3,000 in 2025, citing U.S. fiscal instability, rising geopolitical tensions, and strong central bank demand.

Likewise, Bank of America (NYSE: BAC) strategist Michael Hartnett projected that gold could surpass the price target, building on the 2024 rally that reached a record high of $2,700.

Gold price analysis

Currently, spot gold continues to consolidate above the $2,600 zone, valued at $2,633 per ounce—a modest 0.05% gain in the past 24 hours. Despite short-term price compression, the yellow metal remains strong on a year-to-date basis, up 27%.

The short-term volatility is driven by a combination of U.S. economic data and global uncertainties, particularly heightened geopolitical risks.

This followed the release of stronger-than-expected U.S. Nonfarm Payrolls (NFP) data for November, which revealed the addition of 227,000 jobs—surpassing the forecast of 200,000—while the unemployment rate held steady at 4.2%. This data boosted expectations for a December Federal Reserve rate cut.

Historically, lower interest rates generally favor gold by reducing the opportunity cost of holding the non-yielding asset.

Meanwhile, geopolitical risks are likely to continue supporting gold prices. Renewed tensions in the Middle East—marked by ceasefire violations between Israel and Hezbollah—and escalating rhetoric from Russia regarding its conflict with Ukraine are likely to bolster demand for safe-haven assets.

Featured image via Shutterstock