Collins J. Okoth

The CEO of Coin Bureau, Nic Puckrin, mentioned that Bitcoin is entering an accumulation phase, signaling possible bullish sentiments among investors to hold the asset long-term. The crypto executive shared a chart from Glassnode showing BTC balances on exchanges have recently dipped to all-time lows.

Nic Puckrin, co-founder and CEO of Coin Bureau, believes Bitcoin is entering an accumulation phase following the recent drop in exchange BTC balances. The accumulation period precedes a rally that could signal an imminent bull cycle.

Nic Puckrin reveals BTC accumulation as exchange balances drop to ATLs

Bitcoin accumulation is ongoing.

Over the past 3 months, Exchange balances have been falling.

The next few weeks are going to be volatile 👀 pic.twitter.com/WvNmjELZbP

— Nic (@nicrypto) October 24, 2024

Puckrin shared a chart from Glassnode showing a divergence between Bitcoin’s price and BTC exchange balances. Exchange balances have dipped to all-time lows as Bitcoin inches closer to an all-time high price after a bearish run at the beginning of October.

The decline in exchange BTC balances could imply that investors prefer to hold their assets in self-custody wallets for the long run rather than keeping them in exchanges. The CEO also predicted that the markets could experience volatility in the next three weeks.

Nic Puckrin also predicted on October 23rd that Bitcoin will surpass its all-time high price of $73,000 by November 8th, regardless of who wins the U.S. elections and assumes the president’s office. Nic Puckrin made the speculation citing data from the options market with key details on contracts with the “special Nov 8th expiry.”

Puckrin highlighted that the options market has a large concentration of open interests at the $75k and $80k levels. Data from CryptoQuant also reveals that the total number of coins held in all exchanges has declined to a low of 2.63 million BTC. The data also signals a growing demand for non-custodial solutions among BTC investors.

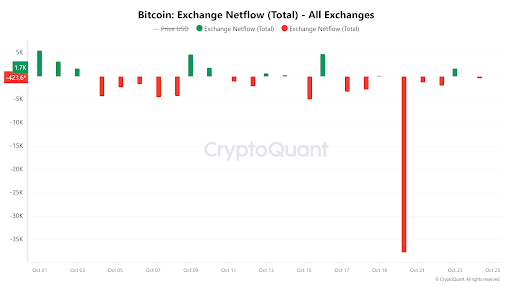

Additional data from CryptoQuant also shows that the net flow of all exchanges, which is the difference between crypto assets flowing into and out of exchanges, was largely negative in October.

On October 20th, all exchanges witnessed a negative net flow of 37,698 BTC, the largest net flow of the month so far. Positive netflow indicates reserves are increasing, while negative netflow indicates reserves are declining.

U.S. elections signal hope for crypto policy changes

The upcoming U.S. presidential elections rank among the most anticipated political events of the year. Republican candidate Donald Trump has actively endorsed the industry. His campaign announced in May that it receives crypto donations in any digital asset accepted through the Coinbase Commerce product.

Kamala Harris’ campaign has also received crypto donations through the Future Forward political action committee (PAC). In early September, a Coinbase spokesperson revealed that the USA PAC would accept crypto donations to fund Harris’ campaign.

The most notable donation for Harris’ campaign involved Ripple’s co-founder, Chris Larsen. The crypto exec announced on October 21st that he would donate $10 million in XRP to fund her campaign, causing a public outcry among Ripple investors.

Although Ripple’s CEO Brad Garlinghouse has maintained a neutral stand on the upcoming elections, he defended the executive, stating that crypto policies will change in the U.S. regardless of who wins the elections.