Rupam Roy

Bitcoin price’s recent movements have stirred attention among investors, with signs of a modest recovery following a sharp decline. Amid this shift, a prominent crypto trader’s bullish outlook on Bitcoin’s future, fueled by significant whale accumulation, has sparked discussions in the crypto community. Notably, as market sentiments sway, the spotlight remains on Bitcoin’s resilience amid ongoing volatility.

Crypto Experts Bullish On BTC As Whale Accumulation Continues

Amid Bitcoin’s recent price turbulence, crypto trader Satoshi Flipper has provided an optimistic forecast, highlighting substantial whale accumulation as a positive indicator for Bitcoin’s recovery. Satoshi Flipper emphasized the notable buying activity by Binance and Bitfinex whales during the current dip, indicating strong investor confidence in Bitcoin’s long-term potential.

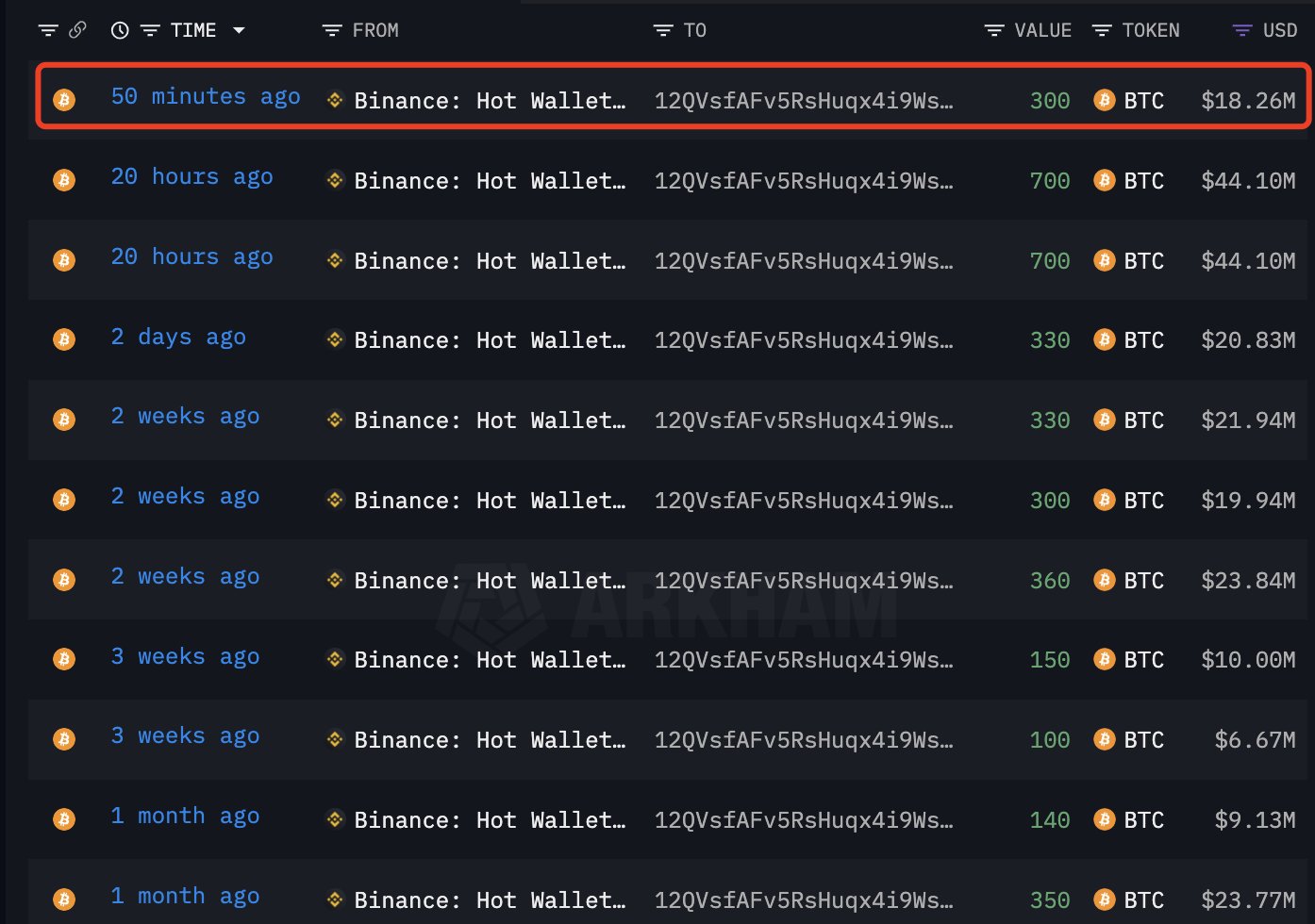

Meanwhile, the crypto trader has provided this optimistic outlook while sharing insights from the on-chain data tracking platform Lookonchain. The recent Lookonchain report revealed a significant whale withdrawal from Binance, totaling 3,760 BTC valued at approximately $242.55 million since March 21.

This accumulation trend, exemplified by the whale acquiring 1400 BTC worth $88.2 million yesterday and 300 BTC worth $18.26 million today, is perceived by analysts as a strategic “buy the dip” opportunity utilized by savvy investors in response to market downturns.

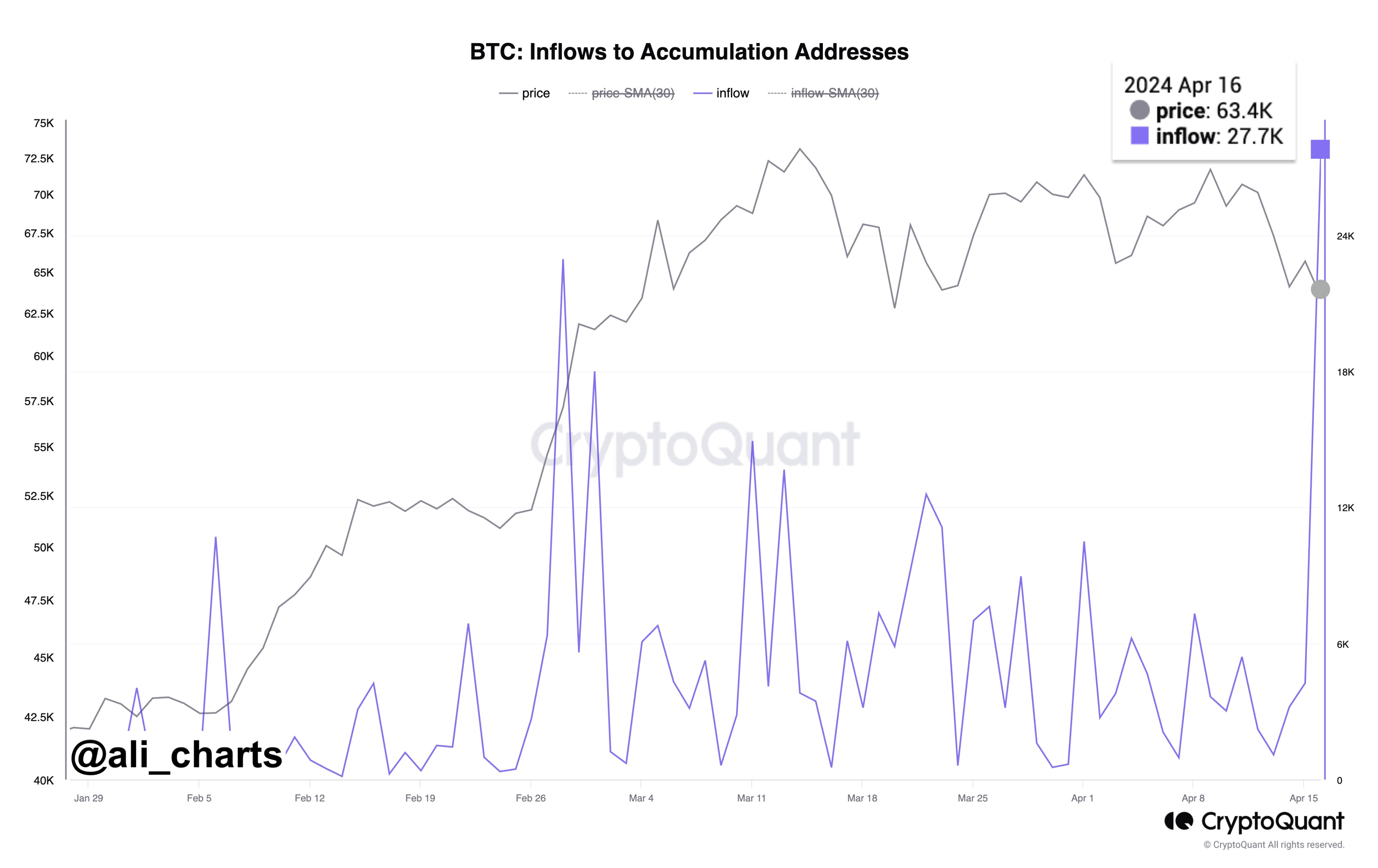

Meanwhile, echoing sentiments of optimism, crypto market analyst Ali Martinez highlighted substantial Bitcoin accumulation, with over 27,700 BTC worth approximately $1.72 billion flowing into accumulation addresses during the recent price dip below $63,000. This influx of BTC into accumulation addresses underscores investor confidence in Bitcoin’s long-term value proposition, despite short-term market fluctuations.

Also Read: Toncoin Teases Major Announcement, What’s Next For TON Price?

Caution Prevails Amid Halving Optimism

Amid these positive indicators, experts caution that the BTC’s recent sharp decline may be attributed to volatility surrounding the Bitcoin Halving event. Historically, BTC, along with the broader crypto market, experiences heightened volatility during Halving events, a phenomenon anticipated to persist amid the current market landscape.

Meanwhile, with the BTC Halving event looming this week, market analysts anticipate continued volatility in Bitcoin’s price trajectory. The Halving event, which reduces the rate at which new Bitcoins are created, often triggers fluctuations in Bitcoin’s supply-demand dynamics, influencing market sentiments and price trends.

As investors brace for potential market swings, the resilience displayed by BTC amid recent challenges, coupled with optimistic outlooks from prominent traders and analysts, underscores the enduring appeal of Bitcoin as a leading cryptocurrency.

Notably, the Bitcoin price was up around 0.17% and traded at $62,958.96 during writing, with its one-day trading volume soaring 21.49% to $43.90 billion. However, despite the slight recovery, the BTC price has lost over 12% in the last seven days.

Also Read: Solana Meme Coin MEW Unveils Major Listing, A Price Recovery Ahead?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.